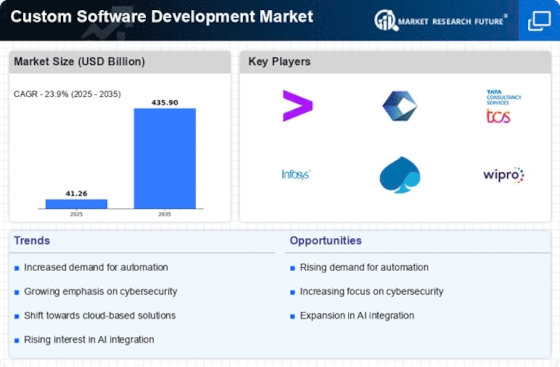

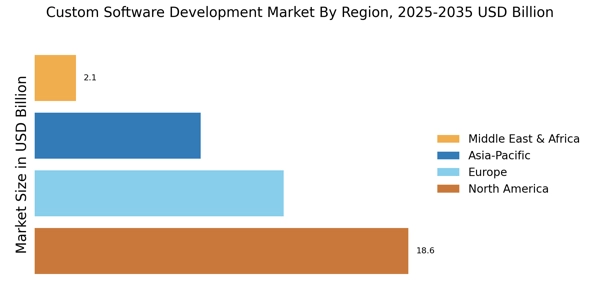

North America : Tech Innovation Leader

North America is the largest market for custom software development, holding approximately 45% of the global market share. The region's growth is driven by rapid technological advancements, increasing demand for digital transformation, and supportive regulatory frameworks. The U.S. and Canada are the primary contributors, with a strong focus on cloud computing and AI integration, fostering a robust ecosystem for software solutions. The Canada custom software development market is gaining traction, supported by increased adoption of cloud-based and AI-enabled enterprise solutions. The competitive landscape is characterized by major players like IBM, Accenture, and Cognizant, which dominate the market with their innovative offerings. The presence of numerous startups and established firms enhances competition, driving continuous improvement and customer-centric solutions. The region's emphasis on R&D and skilled workforce further solidifies its position as a leader in custom software development.

Europe : Emerging Digital Hub

Europe is the second-largest market for custom software development, accounting for around 30% of the global market share. The region's growth is fueled by increasing investments in digital technologies, regulatory support for innovation, and a rising demand for tailored software solutions across various sectors. Countries like Germany and the UK are at the forefront, driving significant advancements in software development practices. The competitive landscape in Europe features key players such as Capgemini and Infosys, alongside a vibrant startup ecosystem. The region is known for its strong emphasis on data protection regulations, which influence software development practices. The presence of diverse industries, from finance to healthcare, creates a dynamic environment for custom software solutions, fostering innovation and collaboration among tech firms.

The Germany custom software development market remains a key contributor, driven by Industry 4.0 adoption and manufacturing software demand. The UK custom software development market is expanding steadily, supported by digital banking, healthcare IT, and regulatory-driven software innovation.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is witnessing rapid growth in the custom software development market, holding approximately 20% of the global market share. The region's expansion is driven by increasing digitalization, a growing number of tech startups, and government initiatives promoting technology adoption. Countries like India and China are leading this growth, with a strong focus on IT services and software exports. The competitive landscape is vibrant, with major players like Tata Consultancy Services and Wipro leading the charge. The region's diverse market demands tailored software solutions across various sectors, including e-commerce, healthcare, and finance. The presence of a large pool of skilled IT professionals and favorable government policies further enhance the region's attractiveness for software development investments.

The APAC custom software development market is experiencing rapid growth, led by strong demand from emerging digital economies and large-scale IT outsourcing hubs. The India custom software development market continues to dominate the region due to a strong talent pool and global service exports. The China custom software development market is expanding steadily, driven by enterprise digitization and domestic technology investments. The Japan custom software development market focuses on high-quality enterprise software, automation, and legacy system modernization. The South Korea custom software development market benefits from advanced digital infrastructure and strong innovation in AI-driven applications.

Middle East and Africa : Emerging Tech Frontier

The Middle East and Africa region is emerging as a significant player in the custom software development market, accounting for about 5% of the global market share. The growth is driven by increasing investments in technology infrastructure, a rising demand for digital solutions, and government initiatives aimed at fostering innovation. Countries like South Africa and the UAE are leading this transformation, focusing on smart city projects and digital services. The competitive landscape is evolving, with local firms and international players vying for market share. The presence of key players is growing, and partnerships between tech companies and government entities are becoming more common. The region's unique challenges, such as varying levels of digital maturity, create opportunities for tailored software solutions that address specific local needs.

The GCC custom software development market is emerging rapidly due to government-led digital transformation programs and smart city initiatives.