Growing Awareness of Genetic Diseases

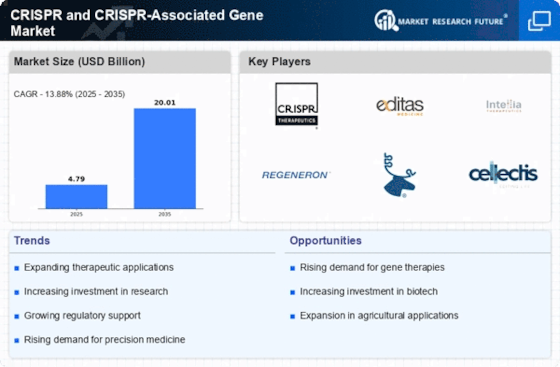

The growing awareness of genetic diseases is significantly influencing the CRISPR and CRISPR-Associated Gene Market. As public understanding of genetic disorders increases, there is a corresponding rise in demand for effective treatment options. This awareness is driving research initiatives aimed at developing CRISPR-based therapies for conditions such as sickle cell anemia, cystic fibrosis, and muscular dystrophy. The market for gene therapies is projected to expand rapidly, with estimates suggesting it could reach over 20 billion USD by 2030. This heightened focus on genetic diseases is likely to encourage investment in CRISPR research and development, thereby propelling the growth of the CRISPR and CRISPR-Associated Gene Market.

Rising Demand for Gene Editing Solutions

The CRISPR and CRISPR-Associated Gene Market is experiencing a notable surge in demand for gene editing solutions. This demand is primarily driven by the increasing prevalence of genetic disorders and the need for innovative therapeutic approaches. As of 2025, the market is projected to reach a valuation of approximately 10 billion USD, reflecting a compound annual growth rate of around 25%. This growth is indicative of the expanding applications of CRISPR technology in areas such as oncology, rare diseases, and genetic research. Furthermore, advancements in CRISPR technology are enabling more precise and efficient gene editing, which is likely to attract further investment and interest from both public and private sectors. Consequently, the rising demand for effective gene editing solutions is a pivotal driver in the CRISPR and CRISPR-Associated Gene Market.

Collaborations and Partnerships in Research

Collaborations and partnerships among academic institutions, research organizations, and biotechnology companies are emerging as a significant driver in the CRISPR and CRISPR-Associated Gene Market. These collaborations facilitate the sharing of knowledge, resources, and expertise, which can accelerate the pace of research and development in gene editing technologies. As of 2025, numerous partnerships are being formed to explore novel applications of CRISPR technology, particularly in therapeutic development and agricultural improvements. Such collaborations not only enhance innovation but also help in navigating regulatory landscapes more effectively. The increasing trend of partnerships is likely to foster a more dynamic research environment, ultimately benefiting the CRISPR and CRISPR-Associated Gene Market.

Increased Focus on Agricultural Biotechnology

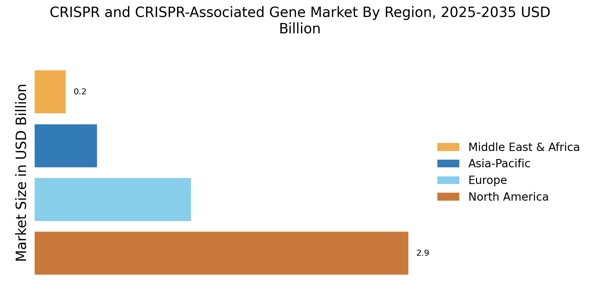

The CRISPR and CRISPR-Associated Gene Market is witnessing an increased focus on agricultural biotechnology. The application of CRISPR technology in agriculture is aimed at enhancing crop yield, improving resistance to pests and diseases, and developing crops with better nutritional profiles. As of 2025, the agricultural biotechnology segment is expected to account for a substantial share of the overall market, driven by the need for sustainable food production in the face of growing global populations. Regulatory bodies are gradually recognizing the potential of CRISPR-modified crops, which may lead to more favorable policies and approvals. This shift towards agricultural applications of CRISPR technology is likely to stimulate further research and investment, thereby contributing to the overall growth of the CRISPR and CRISPR-Associated Gene Market.

Technological Advancements in CRISPR Techniques

Technological advancements are playing a crucial role in shaping the CRISPR and CRISPR-Associated Gene Market. Innovations such as CRISPR-Cas9, CRISPR-Cas12, and base editing are enhancing the precision and efficiency of gene editing processes. These advancements are not only improving the outcomes of genetic modifications but are also expanding the range of potential applications. For instance, the introduction of high-throughput CRISPR screening methods is facilitating large-scale genetic studies, which could lead to breakthroughs in drug discovery and development. As these technologies continue to evolve, they are likely to attract significant investment, further propelling the growth of the market. The ongoing research and development efforts in this domain suggest a promising future for the CRISPR and CRISPR-Associated Gene Market.