Market Growth Projections

Health and Wellness Trends

The Global cream cheese Industry is also shaped by the growing health and wellness trends among consumers. There is a rising interest in products that offer lower fat and reduced-calorie options without compromising taste. This trend encourages manufacturers to develop cream cheese variants that cater to health-conscious consumers, such as organic and plant-based options. As a result, the market is likely to witness a compound annual growth rate of 4.7% from 2025 to 2035. By aligning product offerings with consumer preferences for healthier alternatives, companies can enhance their competitive edge and capture a larger share of the market.

Innovative Product Development

Innovation plays a crucial role in the Global Cream Cheese Industry, as manufacturers continuously seek to differentiate their products. The introduction of flavored cream cheeses, such as herb-infused or fruit-flavored varieties, caters to diverse consumer tastes and culinary applications. This innovation not only attracts new customers but also encourages existing consumers to experiment with cream cheese in various recipes. The focus on product development is likely to drive market growth, as companies invest in research and development to create unique offerings. By staying ahead of trends and consumer preferences, manufacturers can maintain relevance in a competitive landscape.

Growth of the Foodservice Sector

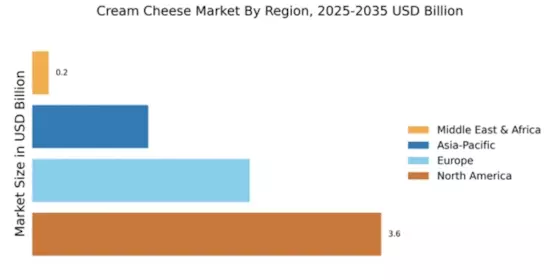

The expansion of the foodservice sector significantly influences the Global Cream Cheese Industry. As restaurants, cafes, and catering services increasingly incorporate cream cheese into their menus, the demand for this versatile ingredient rises. The foodservice industry is projected to continue its growth, contributing to the anticipated market value of 12.0 USD Billion by 2035. This growth is likely attributed to the rising trend of gourmet dining and the popularity of cream cheese-based dishes, such as bagels and cheesecakes. Additionally, the increasing number of food establishments globally creates opportunities for cream cheese manufacturers to establish partnerships and expand their distribution channels.

Rising Demand for Dairy Products

The Global Cream Cheese Industry experiences a notable surge in demand for dairy products, driven by increasing consumer preferences for rich and creamy textures in culinary applications. As consumers become more health-conscious, they seek out products that offer both indulgence and nutritional benefits. This trend is reflected in the projected market value of 7.23 USD Billion in 2024, indicating a robust growth trajectory. The shift towards using cream cheese in various recipes, including spreads, dips, and desserts, further fuels this demand. Consequently, manufacturers are innovating to meet consumer expectations, thereby enhancing their market presence.

E-commerce and Online Retail Growth

The rise of e-commerce and online retail platforms significantly impacts the Global Cream Cheese Industry. As consumers increasingly turn to online shopping for convenience, the availability of cream cheese products through various digital channels expands. This trend is particularly relevant in urban areas, where busy lifestyles drive the demand for easy access to grocery items. The growth of online grocery shopping is expected to facilitate market expansion, allowing consumers to explore a wider range of cream cheese options. Consequently, manufacturers and retailers are likely to enhance their online presence, ensuring that they meet the evolving preferences of consumers.