Increased Focus on Sustainability

The Crawler Dozers Market is witnessing a shift towards sustainability, driven by environmental regulations and the need for eco-friendly construction practices. Manufacturers are increasingly developing crawler dozers that utilize cleaner technologies and reduce emissions, aligning with global sustainability goals. The introduction of hybrid and electric crawler dozers is indicative of this trend, as they offer reduced fuel consumption and lower environmental impact. Market data suggests that the demand for sustainable machinery is expected to rise by 15% over the next five years, reflecting a growing awareness of environmental issues within the construction and mining sectors. This focus on sustainability not only enhances the appeal of crawler dozers but also positions the industry favorably in a market that increasingly values eco-conscious practices.

Rising Demand in Mining Operations

The Crawler Dozers Market is significantly influenced by the rising demand for crawler dozers in mining operations. As mining activities expand to meet the growing need for minerals and resources, the requirement for robust and reliable machinery becomes increasingly critical. Crawler dozers are essential for land clearing, site preparation, and material handling in mining sites. Recent statistics indicate that the mining sector is expected to grow at a rate of 4% annually, which directly correlates with the demand for crawler dozers. This growth is driven by the need for efficient extraction processes and the management of large volumes of earth and materials. Consequently, the crawler dozers market is poised for expansion as mining operations continue to evolve.

Infrastructure Development Initiatives

The Crawler Dozers Market is experiencing a notable surge due to increased infrastructure development initiatives across various regions. Governments are investing heavily in the construction of roads, bridges, and urban facilities, which necessitates the use of heavy machinery, including crawler dozers. For instance, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years, driving demand for crawler dozers. These machines are essential for earthmoving and grading tasks, making them indispensable in large-scale projects. As urbanization continues to rise, the need for efficient and reliable construction equipment becomes paramount, further propelling the crawler dozers market. This trend indicates a robust future for the industry as infrastructure projects expand.

Technological Advancements in Machinery

Technological advancements are playing a crucial role in shaping the Crawler Dozers Market. Innovations such as automation, telematics, and advanced hydraulic systems are enhancing the efficiency and performance of crawler dozers. The integration of smart technologies allows for real-time monitoring and data analysis, which can lead to improved operational efficiency and reduced downtime. According to recent data, the adoption of advanced machinery is expected to increase productivity by up to 20% in construction projects. This trend not only boosts the appeal of crawler dozers but also aligns with the industry's shift towards more sustainable and efficient practices. As manufacturers continue to innovate, the crawler dozers market is likely to witness significant growth driven by these technological enhancements.

Expansion of Construction Activities in Emerging Economies

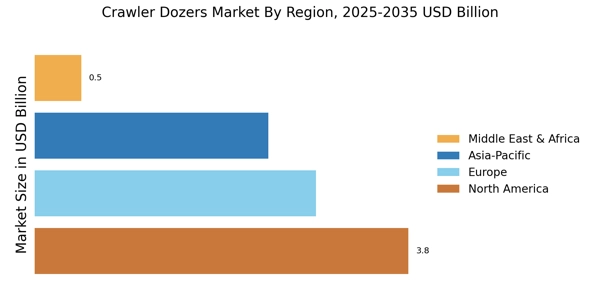

The Crawler Dozers Market is benefiting from the expansion of construction activities in emerging economies. As these regions experience rapid urbanization and economic growth, the demand for construction equipment, including crawler dozers, is on the rise. Countries in Asia and Africa are investing in infrastructure projects to support their growing populations, which is expected to drive the crawler dozers market significantly. Recent projections indicate that construction spending in these regions could increase by over 10% annually, creating a substantial market for crawler dozers. This trend suggests that manufacturers should focus on these emerging markets to capitalize on the growing demand for heavy machinery. The expansion of construction activities in these economies presents a promising opportunity for the crawler dozers market.