Regulatory Compliance

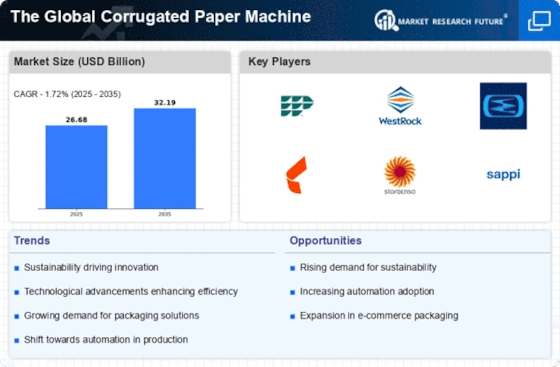

Regulatory compliance regarding packaging materials is becoming an increasingly important driver for the corrugated paper machine market. Governments worldwide are implementing stricter regulations aimed at reducing plastic waste and promoting sustainable packaging practices. These regulations compel manufacturers to adopt more environmentally friendly materials, such as corrugated paper, which is both recyclable and biodegradable. Compliance with these regulations not only helps companies avoid penalties but also enhances their brand reputation among environmentally conscious consumers. Market trends indicate that businesses prioritizing compliance are likely to gain a competitive edge, as they align with consumer preferences for sustainable products. Consequently, the push for regulatory compliance is expected to significantly influence the growth and evolution of the corrugated paper machine market.

Rising E-commerce Sector

The rapid expansion of the e-commerce sector is a significant driver for the corrugated paper machine market. As online shopping continues to gain traction, the demand for efficient and protective packaging solutions has escalated. Corrugated paper is favored for its lightweight yet sturdy characteristics, making it ideal for shipping a variety of products. Recent statistics indicate that the e-commerce market is projected to grow at a robust rate, further amplifying the need for corrugated packaging. This growth presents opportunities for manufacturers to enhance their production capabilities and innovate new packaging solutions tailored for e-commerce applications. As a result, the corrugated paper machine market is likely to experience sustained growth, driven by the increasing volume of goods being shipped globally.

Technological Innovations

Technological advancements play a crucial role in shaping the corrugated paper machine market. The introduction of automation and smart technologies has revolutionized production processes, enhancing efficiency and reducing operational costs. For instance, the integration of IoT devices allows for real-time monitoring and predictive maintenance, which minimizes downtime and maximizes productivity. Furthermore, advancements in machine design and materials have led to the development of high-speed, energy-efficient machines that cater to the growing demand for rapid production. Market data indicates that the adoption of such technologies is expected to increase, as manufacturers seek to remain competitive in a rapidly evolving landscape. This drive towards innovation not only improves the quality of corrugated products but also supports the overall growth trajectory of the corrugated paper machine market.

Sustainability Initiatives

The increasing emphasis on sustainability is a pivotal driver for the corrugated paper machine market. As businesses and consumers alike become more environmentally conscious, the demand for eco-friendly packaging solutions rises. Corrugated paper, being recyclable and biodegradable, aligns well with these sustainability goals. In recent years, the market has witnessed a surge in investments aimed at enhancing the efficiency of corrugated paper machines, which in turn reduces waste and energy consumption. According to industry reports, the market for sustainable packaging is projected to grow significantly, with corrugated solutions expected to capture a substantial share. This trend not only supports environmental objectives but also encourages manufacturers to innovate and improve their production processes, thereby driving growth in the corrugated paper machine market.

Customization and Flexibility

The need for customization and flexibility in packaging solutions is increasingly influencing the corrugated paper machine market. As businesses strive to differentiate their products, the demand for tailored packaging solutions has surged. This trend is particularly evident in sectors such as e-commerce and food delivery, where unique packaging designs can enhance brand identity and customer experience. Manufacturers are responding by developing machines that offer greater versatility in terms of size, shape, and design capabilities. Market analysis suggests that the ability to produce customized corrugated products efficiently will be a key competitive advantage. Consequently, this drive for customization not only meets consumer preferences but also propels innovation within the corrugated paper machine market, fostering a dynamic environment for growth.