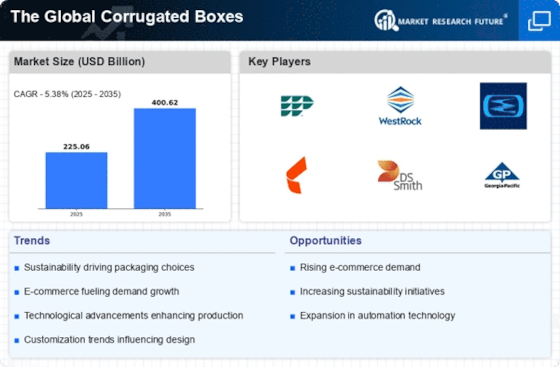

E-commerce Expansion

The rapid expansion of e-commerce is a major catalyst for the corrugated boxes market. With online shopping becoming a preferred method for consumers, the demand for efficient and protective packaging solutions has escalated. In 2025, the e-commerce sector is anticipated to account for a significant portion of retail sales, driving the need for corrugated boxes that can withstand shipping and handling. This trend is particularly evident in sectors such as electronics, fashion, and food delivery, where packaging integrity is crucial. As e-commerce continues to flourish, the corrugated boxes market is poised to benefit from increased orders and the necessity for customized packaging solutions that enhance the customer experience.

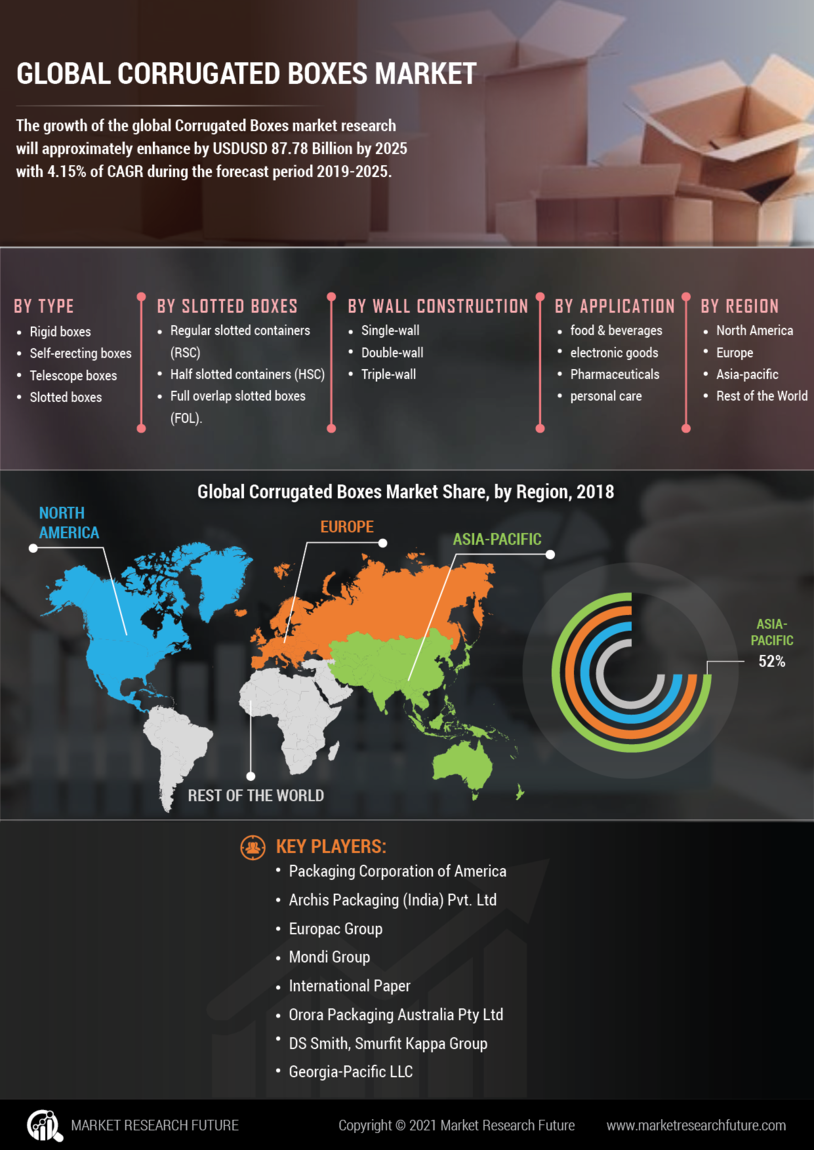

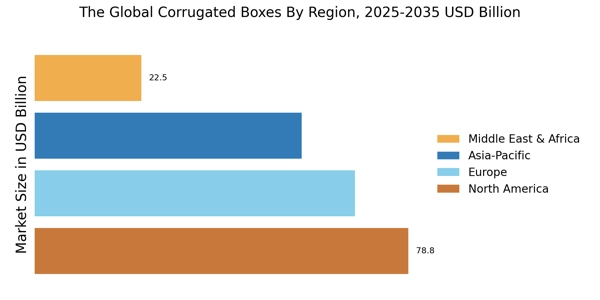

Global Trade Dynamics

The dynamics of The Global Corrugated Boxes industry, as international shipping and logistics continue to expand. The rise in cross-border trade has led to an increased need for durable packaging solutions that can withstand long-distance transportation. Corrugated boxes are favored for their lightweight yet robust characteristics, making them ideal for shipping a variety of products. In 2025, the growth of global trade is expected to drive demand for corrugated boxes, particularly in emerging markets where manufacturing and export activities are on the rise. This trend suggests that the corrugated boxes market will benefit from the increasing volume of goods being transported internationally, necessitating reliable packaging solutions.

Technological Innovations

Technological advancements are reshaping the corrugated boxes market, leading to enhanced production processes and product offerings. Innovations such as automated manufacturing and digital printing are streamlining operations, reducing costs, and improving efficiency. The integration of smart technologies, such as IoT and AI, is also enabling manufacturers to optimize supply chains and enhance inventory management. These advancements not only improve the quality of corrugated boxes but also allow for greater customization, catering to specific customer needs. As technology continues to evolve, the corrugated boxes market is likely to witness increased competitiveness and the emergence of new business models that leverage these innovations.

Sustainability Initiatives

The increasing emphasis on sustainability is a pivotal driver for the corrugated boxes market. As consumers and businesses alike become more environmentally conscious, the demand for eco-friendly packaging solutions has surged. Corrugated boxes, being recyclable and biodegradable, align well with these sustainability initiatives. In fact, the market for sustainable packaging is projected to grow significantly, with corrugated boxes expected to capture a substantial share due to their minimal environmental impact. Companies are increasingly adopting sustainable practices, which not only enhances their brand image but also meets regulatory requirements. This shift towards sustainability is likely to propel the corrugated boxes market forward, as manufacturers innovate to create greener products that cater to the evolving preferences of consumers.

Rising Demand in Food and Beverage Sector

The food and beverage sector is experiencing a notable increase in demand for corrugated boxes, serving as a significant driver for the market. With the growing trend of takeout and delivery services, the need for sturdy and reliable packaging has intensified. Corrugated boxes provide excellent protection for food items, ensuring they remain fresh during transit. In 2025, the food and beverage industry is expected to contribute substantially to the overall demand for corrugated packaging solutions. This trend is further supported by the increasing focus on convenience and sustainability among consumers, prompting food businesses to adopt eco-friendly packaging options. Consequently, the corrugated boxes market is likely to thrive as it caters to the evolving needs of this dynamic sector.