Regulatory Changes

Regulatory changes are significantly influencing the Global Corporate Banking Market Industry. Governments worldwide are implementing stricter regulations to ensure financial stability and protect consumers. For example, the Basel III framework mandates higher capital requirements for banks, which could lead to a more resilient banking sector. While these regulations aim to mitigate risks, they may also impose additional compliance costs on banks. Consequently, institutions that adapt effectively to these changes may gain a competitive edge. The evolving regulatory landscape is likely to shape the market dynamics, impacting growth trajectories as the industry approaches a projected size of 2326.8 USD Billion by 2035.

Global Economic Growth

The Global Corporate Banking Market Industry is closely tied to the overall economic growth of nations. As economies expand, corporate entities often seek financial services to support their growth initiatives, leading to increased demand for corporate banking solutions. For instance, emerging markets are experiencing robust economic growth, which is driving the need for financing options. This trend is expected to bolster the corporate banking sector, as businesses require capital for expansion, mergers, and acquisitions. However, fluctuations in economic conditions could pose challenges. The anticipated decline in market size with a CAGR of -12.17% from 2025 to 2035 may reflect economic uncertainties impacting corporate financing.

Technological Advancements

The Global Corporate Banking Market Industry is witnessing a transformative phase driven by rapid technological advancements. Innovations such as artificial intelligence, blockchain, and big data analytics are reshaping banking operations, enhancing efficiency, and improving customer experiences. For instance, banks are increasingly adopting AI-driven chatbots for customer service, which streamlines operations and reduces costs. The integration of blockchain technology is facilitating secure and transparent transactions, thereby attracting more corporate clients. As these technologies evolve, they are expected to play a pivotal role in the industry's growth, contributing to the projected market size of 9700.2 USD Billion in 2024.

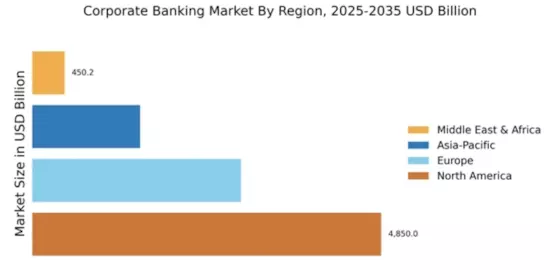

Chart: Market Size Projections

The Global Corporate Banking Market Industry is projected to experience notable fluctuations in market size over the coming years. In 2024, the market is expected to reach 9700.2 USD Billion, reflecting robust activity and demand. However, forecasts indicate a decline, with the market size anticipated to drop to 2326.8 USD Billion by 2035. This projection suggests a potential contraction in the industry, with a CAGR of -12.17% from 2025 to 2035. These figures underscore the dynamic nature of the corporate banking landscape, influenced by various economic and regulatory factors.

Increased Demand for Sustainable Financing

There is a growing emphasis on sustainable financing within the Global Corporate Banking Market Industry. Corporations are increasingly prioritizing environmental, social, and governance (ESG) criteria in their operations, leading to a surge in demand for green financing solutions. Banks are responding by developing products that align with sustainability goals, such as green bonds and sustainable loans. This shift not only meets the evolving expectations of corporate clients but also positions banks favorably in a competitive landscape. As sustainability becomes a core focus, the corporate banking sector is likely to witness a transformation, adapting to these new demands while contributing to broader environmental objectives.