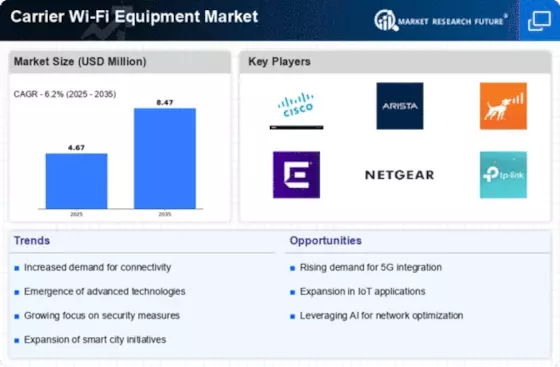

Adoption of 5G Technology

The rollout of 5G technology is poised to have a profound impact on the Carrier Wi-Fi Equipment Market. As 5G networks become more prevalent, they are expected to complement existing Wi-Fi infrastructure, providing enhanced connectivity options for users. The integration of 5G with Wi-Fi networks can potentially improve overall network performance, enabling faster data transfer rates and reduced latency. Industry forecasts suggest that the global 5G services market could reach hundreds of billions of dollars by the end of the decade. This growth indicates a strong demand for Carrier Wi-Fi equipment that can seamlessly integrate with 5G technology, allowing service providers to offer superior connectivity solutions. As a result, the Carrier Wi-Fi Equipment Market is likely to evolve in response to the advancements in mobile network technology.

Expansion of Smart Cities

The development of smart cities is significantly influencing the Carrier Wi-Fi Equipment Market. As urban areas increasingly integrate technology to improve infrastructure and services, the demand for robust Wi-Fi networks is escalating. Smart city initiatives often rely on interconnected devices and real-time data sharing, necessitating reliable and extensive Wi-Fi coverage. Reports indicate that investments in smart city projects are projected to reach trillions of dollars over the next decade, creating a substantial market for Carrier Wi-Fi equipment. This trend suggests that municipalities and service providers will prioritize the deployment of advanced Wi-Fi solutions to support smart applications, such as traffic management and public safety systems. Thus, the Carrier Wi-Fi Equipment Market stands to benefit from the ongoing urbanization and technological advancements associated with smart city developments.

Rise of Mobile Data Consumption

The Carrier Wi-Fi Equipment Market is being propelled by the increasing consumption of mobile data. With the proliferation of smartphones and mobile devices, users are consuming more data than ever before. Recent statistics reveal that mobile data traffic is expected to grow exponentially, potentially reaching over 77 exabytes per month by 2025. This surge in mobile data usage is prompting service providers to enhance their Wi-Fi infrastructure to accommodate the growing demand. As users seek seamless connectivity in various environments, including public spaces and commercial establishments, the need for Carrier Wi-Fi solutions becomes critical. Consequently, the Carrier Wi-Fi Equipment Market is likely to witness significant growth as operators invest in technologies that can support high-density environments and deliver consistent performance.

Increased Focus on Network Security

The Carrier Wi-Fi Equipment Market is witnessing a heightened emphasis on network security. As cyber threats become more sophisticated, service providers are compelled to invest in secure Wi-Fi solutions to protect user data and maintain trust. Recent studies indicate that a significant percentage of organizations have experienced security breaches, underscoring the need for robust security measures in Wi-Fi networks. This trend is likely to drive demand for Carrier Wi-Fi equipment that incorporates advanced security features, such as encryption and authentication protocols. Furthermore, regulatory requirements regarding data protection are becoming more stringent, prompting operators to prioritize security in their network deployments. Consequently, the Carrier Wi-Fi Equipment Market is expected to grow as companies seek to enhance their security posture in an increasingly digital landscape.

Increasing Demand for High-Speed Internet

The Carrier Wi-Fi Equipment Market is experiencing a surge in demand for high-speed internet connectivity. As consumers and businesses alike seek faster and more reliable internet services, the need for advanced Wi-Fi solutions becomes paramount. According to recent data, the number of internet users has reached approximately 5 billion, indicating a growing reliance on digital services. This trend is likely to drive investments in Carrier Wi-Fi equipment, as service providers aim to enhance their infrastructure to meet user expectations. Furthermore, the proliferation of streaming services and online gaming is pushing the boundaries of bandwidth requirements, compelling operators to adopt cutting-edge Wi-Fi technologies. Consequently, the Carrier Wi-Fi Equipment Market is poised for substantial growth as it adapts to these evolving consumer demands.