Rising Security Concerns

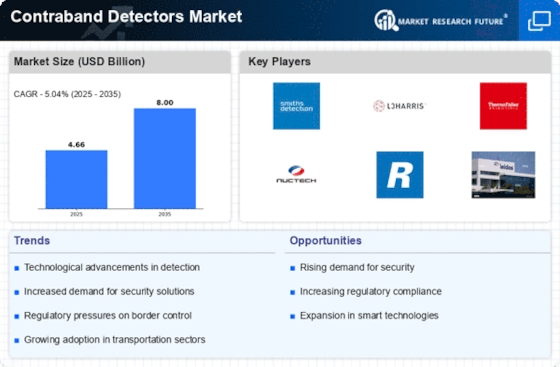

The Contraband Detectors Market is experiencing growth due to rising security concerns across various sectors. With the increase in illicit activities, including drug trafficking and smuggling, there is a heightened demand for effective detection systems. Organizations are investing in advanced contraband detection technologies to safeguard their operations and ensure compliance with security protocols. The market is projected to expand as businesses and government agencies prioritize security measures. According to recent estimates, the market is expected to reach a valuation of USD 3 billion by 2027, reflecting the urgency to address security challenges. This growing awareness of security risks is likely to drive innovation and investment in the Contraband Detectors Market.

Regulatory Compliance and Standards

The Contraband Detectors Market is significantly influenced by stringent regulatory compliance and standards imposed by various governmental bodies. These regulations mandate the use of effective detection systems in critical sectors such as transportation, customs, and law enforcement. Compliance with these regulations not only ensures public safety but also enhances the credibility of organizations involved in security operations. The market is witnessing an increase in demand for detectors that meet these regulatory requirements, which is expected to drive growth. In recent years, the implementation of international standards for contraband detection has become more prevalent, further solidifying the need for advanced detection technologies. This trend is likely to continue, as organizations strive to adhere to evolving regulations, thereby boosting the Contraband Detectors Market.

Emerging Markets and Global Expansion

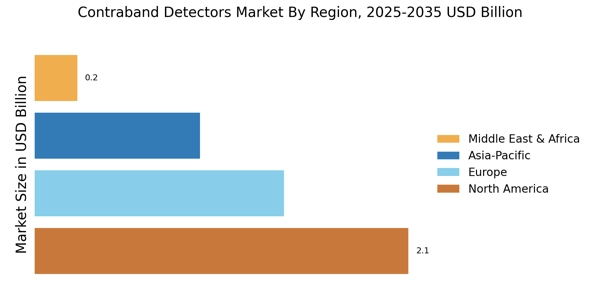

The Contraband Detectors Market is poised for growth as emerging markets expand their security capabilities. Countries in Asia, Africa, and Latin America are increasingly recognizing the need for effective contraband detection systems to combat rising crime rates and enhance border security. This expansion is driven by economic growth and the desire to improve public safety. As these regions invest in modern security technologies, the demand for advanced contraband detectors is expected to rise. Market analysts predict that the industry will see a significant increase in adoption rates in these emerging markets, potentially leading to a market valuation of USD 4 billion by 2028. This trend indicates a shift in the Contraband Detectors Market, as it adapts to the evolving security landscape in various regions.

Increased Investment in Security Infrastructure

The Contraband Detectors Market is benefiting from increased investment in security infrastructure by both public and private sectors. Governments are allocating substantial budgets to enhance border security and law enforcement capabilities, which includes the procurement of advanced contraband detection systems. This trend is particularly evident in regions facing significant security threats, where the need for robust detection solutions is paramount. The market is projected to grow as organizations recognize the importance of investing in state-of-the-art detection technologies to mitigate risks. Furthermore, private sector companies are also investing in security measures to protect their assets, contributing to the overall growth of the Contraband Detectors Market. This influx of investment is likely to foster innovation and drive the development of more effective detection solutions.

Technological Advancements in Detection Methods

The Contraband Detectors Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as artificial intelligence and machine learning are enhancing detection capabilities, allowing for more accurate identification of contraband materials. For instance, the integration of advanced imaging technologies, including 3D scanning and hyperspectral imaging, is becoming increasingly prevalent. These technologies not only improve detection rates but also reduce false positives, thereby increasing operational efficiency. The market is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years, driven by these advancements. As security concerns escalate, the demand for sophisticated detection methods is likely to rise, further propelling the Contraband Detectors Market.