Rising Data Transmission Needs

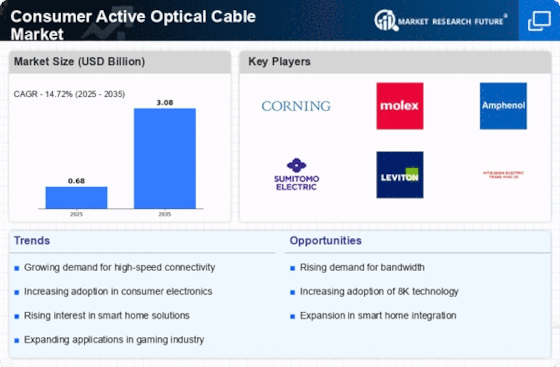

The increasing demand for high-speed data transmission is a primary driver for the Consumer Active Optical Cable Market. As digital content consumption surges, particularly in sectors such as streaming services and online gaming, the need for faster and more reliable connections becomes paramount. Active optical cables, with their ability to support high bandwidth and long-distance transmission, are well-positioned to meet these requirements. Market data indicates that the demand for data centers and cloud services is expected to grow significantly, further propelling the need for advanced cabling solutions. This trend suggests that the Consumer Active Optical Cable Market will continue to expand as businesses and consumers alike seek efficient data transfer solutions.

Expansion of Smart Home Devices

The rapid expansion of smart home devices is significantly influencing the Consumer Active Optical Cable Market. As households increasingly adopt interconnected devices, the need for reliable and high-speed connectivity becomes critical. Active optical cables facilitate the seamless integration of various smart technologies, ensuring that devices communicate effectively without latency issues. Market analysis suggests that the smart home market is projected to grow substantially, with millions of new devices expected to be connected in the coming years. This trend underscores the importance of robust cabling solutions, positioning the Consumer Active Optical Cable Market as a key player in supporting the infrastructure required for smart homes.

Growing Focus on Energy Efficiency

The growing emphasis on energy efficiency is influencing the Consumer Active Optical Cable Market. As consumers and businesses become more environmentally conscious, there is a shift towards solutions that minimize energy consumption while maximizing performance. Active optical cables are often more energy-efficient than traditional copper cables, as they require less power to transmit data over long distances. This characteristic aligns with sustainability initiatives across various sectors, prompting a shift in preference towards optical solutions. Market data suggests that energy-efficient technologies are gaining traction, indicating a potential growth area for the Consumer Active Optical Cable Market as it adapts to meet the demands of eco-conscious consumers.

Increased Adoption of 4K and 8K Technologies

The proliferation of 4K and 8K video technologies is driving the Consumer Active Optical Cable Market. These high-definition formats require substantial bandwidth for seamless streaming and playback, which traditional copper cables often cannot provide. Active optical cables, capable of delivering high data rates over longer distances without signal degradation, are becoming essential for consumers and businesses investing in advanced audiovisual equipment. As more households and commercial establishments upgrade to 4K and 8K displays, the demand for compatible cabling solutions is likely to rise. This shift indicates a robust growth trajectory for the Consumer Active Optical Cable Market, as manufacturers respond to the evolving needs of consumers seeking superior viewing experiences.

Emerging Virtual and Augmented Reality Applications

The rise of virtual reality (VR) and augmented reality (AR) applications is emerging as a significant driver for the Consumer Active Optical Cable Market. These technologies demand high data rates and low latency to deliver immersive experiences, which traditional cabling solutions may struggle to provide. Active optical cables, with their superior performance characteristics, are increasingly being adopted in sectors such as gaming, education, and training. As the market for VR and AR continues to expand, the need for advanced cabling solutions is likely to grow. This trend indicates that the Consumer Active Optical Cable Market will play a crucial role in supporting the infrastructure necessary for these innovative applications.