Construction Materials Testing Equipment Size

Construction Materials Testing Equipment Market Growth Projections and Opportunities

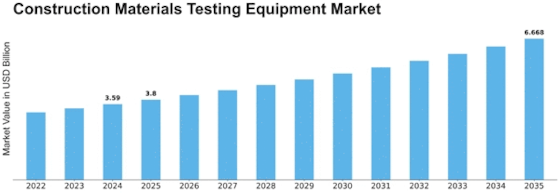

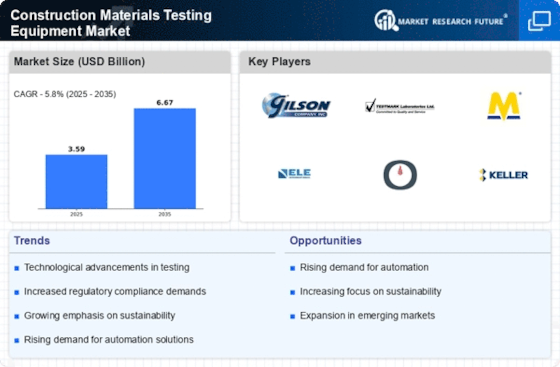

The construction materials testing equipment market is an industry that has a lot of market drivers that impact its dynamics. One of the main factors behind this expansion in the market is constant development in the construction field. Construction Materials Testing Equipment Market Size reached USD 3.2 billion in 2022. According to our forecast, the Construction Materials Testing Equipment industry is expected to grow from $ 3.39 bn in 2023 to $ 5.32 bn by the end of the period, registering a CAGR of 5.80%. Mechanization and automation are some examples. Technological innovations like computer-integrated manufacturing systems, the use of robots, and sophisticated machinery have been instrumental in modernizing and improving the efficiency of the construction process. In addition to a booming building sector, technological advancements also shape the market structure. Growth in construction materials testing equipment is attributed to improvements such as integration with automation and IoT technology, which increases accuracy and enhances efficiency during testing processes. The new developments are meant to deal with both the growing demand for appropriate devices as well as modernization of the entire building industry. Moreover, environmental considerations drive market trends. As sustainable construction becomes more popular, there is a rising need for materials testing instrumentations capable of evaluating environmental impacts caused by different types of construction materials, including items like recyclability, energy efficiency, and compliance with ecological norms. Another important factor impacting the growth rate within this niche is stringent standards. Rigorous quality control measures geared at ensuring the integrity plus durability of constructed infrastructure have necessitated governments across the globe to implement stiff regulations regarding their design. Furthermore it has led to an increase in demand for sophisticated test kits that can satisfy these international standards. Manufacturers are always looking into changing requirements, thereby innovating ways of adopting products according to the law. Many key players dominate this highly competitive landscape where various types of materials testing equipment are available. Therefore, it can be stated with confidence that the competition level tends to be high, leading to constant evolution and development of products. Market participants are focused on expanding their product lines to reach more customers. Buyers gain access to several of the latest solutions, thus promoting an active market with healthy competition. Economic conditions also influence market factors. Economic downturns may cause a temporary halt in construction projects, resulting in a negative impact on the market. However, recessions and investors' increased interest in infrastructural projects could increase the need for materials testing equipment.

Leave a Comment