Market Share

Construction Materials Testing Equipment Market Share Analysis

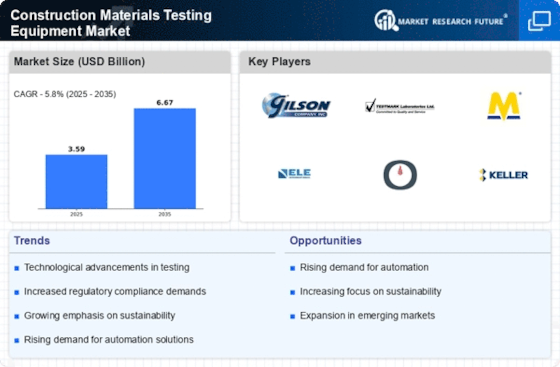

The Construction Materials Testing Equipment (CMTE) market is an integral part of the building industry as it provides an essential means for checking the quality and durability of materials used in structures. Differentiation is one of the common strategies employed by companies operating within the CMTE sector. Such firms can differentiate themselves by offering unique testing tools that appeal to consumers who prioritize modern features and better performance. Thus, this business strategy helps the company to differentiate itself from its competitors. At the same time, it enables the firm to sell its specialized goods at a high premium. This involves, for example, investing in sophisticated technologies such as state-of-the-art evolutionary developments, including automated testing systems or higher precision sensors, which would, therefore, give them a competitive edge. Another important technique is centered on cost leadership, where companies concentrate on manufacturing high-quality testing equipment at reduced production costs to be able to supply them at competitive prices that may attract a greater number of potential clients. Also, market segmentation is one of the biggest strategies within the CMTE business. This means that companies divide their customers into different groups based on factors such as geographical location, end-users, or specific testing requirements. In order to become specialists in some niches, they can, therefore, tailor their products and marketing strategies so as to react to the needs of these segments. For example, a certain company might focus particularly on geotechnical testing equipment for targeted regions characterized by unique standards. In the CMTE industry, strategic partnerships and collaborations have been increasingly used as effective mechanisms to gain market share. To increase their product portfolio and extend their reach across the market globally, businesses could partner with construction firms and institutions for research or other test equipment manufacturers. Such alliances may lead to combined solutions involving testing machines integrated with other building techniques so as to provide comprehensive answers for clients. Additionally, there are various other strategies, such as customer care, which are very vital in this CMTE market. By providing excellent service delivery systems coupled with prompt assistance plus orientation services through training programs, among others, an organization can maintain relationships while achieving repeat business and gaining word-of-mouth recommendations from satisfied customers. Moreover, concerned customers will serve as assets that contribute to a company's reputation and increase its market shares.

Leave a Comment