Construction Glass Size

Construction Glass Market Growth Projections and Opportunities

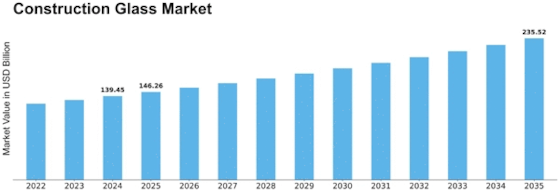

The Construction Glass Market Size was valued at USD 115.98 Billion in 2022. By 2030, this industry will grow to reach a market size of USD 200.81 billion from the current value of USD 116.01 billion, which corresponds to a compound annual growth rate (CAGR) of 7.28%. This market is shaped by many factors that work together to determine its behavior. The global construction industry, where construction glass is an important material for modern and aesthetically appealing structures, has been one of the main drivers of the Construction Glass market worldwide. Urbanization all over the world, coupled with developing infrastructure facilities, has seen a rise in demand for construction glass due to its versatility, energy conservation, and ability to improve natural lighting in buildings. Glass is used as a building material for windows, facades and other architectural features that provide both functionality and aesthetic appeal to modern buildings. Significant technological advances in glass manufacturing and processing have also driven market dynamics forward. The industry's ongoing research and development efforts focus on improving the thermal performance, strength, and design flexibility of construction glass materials such as tinted glass or laminated safety. Architectural trends and design preferences play a crucial role in shaping the Construction Glass market. As new roofing styles are being embraced by society, there has been increased use of glass in modern houses. Therefore, government regulations related to energy efficiency and building standards significantly impact the Construction Glass market. Compliance with regulations promoting energy-efficient building envelopes or safety standards is critical. Market trends may be influenced by regulatory changes like those promoting green building practices, leading to wider adoption of construction glasses that conform to or surpass the latest industrial standards. Environmental impacts are increasingly determining what happens within the construction glass markets. As sustainable constructions gain popularity across various industries, there has been increased demand for energy-efficient as well as environmentally friendly glasses. Economic factors such as construction spending and real estate development influence the Construction Glass market. Economic stability and increased investment in infrastructure contribute to the adoption of construction glass in various projects. Competition within the glass manufacturing industry shapes the dynamics of the glass construction market. Companies invest in research and development to create innovative glass products, improve energy efficiency, and meet the evolving demands of the construction industry. Consumers who are aware of these advantages will increasingly use them. As more knowledge about energy saving, natural light optimization, and aesthetics comes to architects, developers, or homeowners, it will lead to increased demand for these products.

Leave a Comment