Market Analysis

In-depth Analysis of Construction Coatings Market Industry Landscape

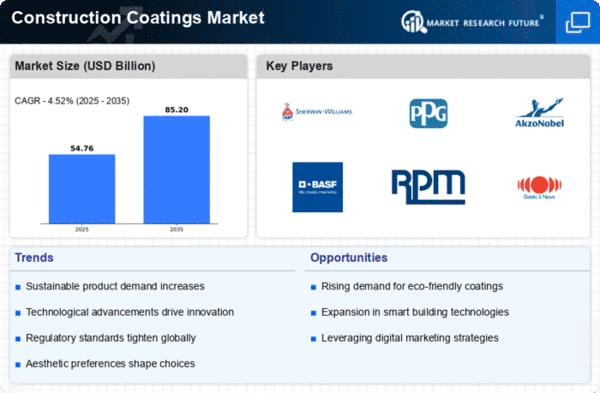

Dynamic forces have a big impact on the building Coatings Market's growth and trends. These forces reflect the complex needs of the building industry and larger economic factors. The building coatings market is mainly driven by the growth of the construction industry as a whole, which is caused by more people moving to cities and better infrastructure. Coatings that protect structures from external factors, improve their appearance, and make them last longer are in high demand, especially in developing economies where construction is growing. A big part of the market for building coatings is made up of architectural coatings like paints and bases. Trends in domestic, business, and public building affect the market. People in the architecture field want coats that look good and last a long time. This affects the market, with a focus on color variety, longevity, and ease of application. The upkeep and rebuilding area is a big part of the construction coatings market. This is because protection coatings are needed on existing buildings to make them last longer and look better. Coatings that effectively clean surfaces, protect against rust, and fix damage affect the market's movement. Specialized uses for industrial paints include protecting steel buildings, pipes, and industrial machinery. Coatings that are resistant to rust, chemicals, and wear and tear in harsh industrial settings drive market trends. Economic trends, government policies, and public-private partnerships can all have an effect on the building coatings market through regional infrastructure spending. It depends on the amount of economic growth, infrastructure development, and government programs that support building operations how the market changes in different areas. The total cost of building paints is affected by changes in the prices of raw materials like resins, colors, and solvents. Problems with the supply chain, like gaps or delays, affect how the market works and how well producers can meet demand. Construction materials are made and used in ways that are affected by rules about health and safety, the environment, and the environment. Following rules, like not using certain chemicals, affects how the market works and encourages the creation of eco-friendly finishing options.

Leave a Comment