Market Share

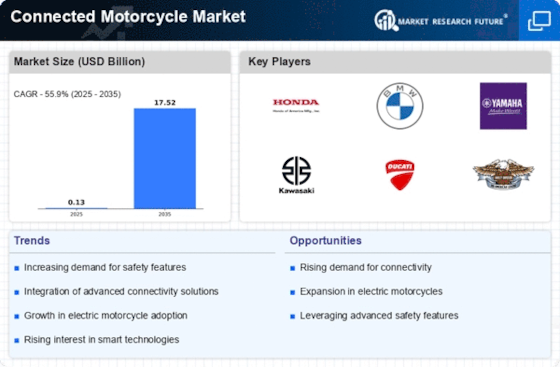

Connected Motorcycle Market Share Analysis

In the dynamic landscape of the motorcycle industry, market share positioning strategies play a pivotal role in establishing a brand's presence and competitiveness. The advent of connected technologies has ushered in a new era for motorcycles, transforming them into intelligent, data-driven vehicles. Connected motorcycles, equipped with features like GPS navigation, real-time diagnostics, and smart safety systems, have carved a niche in the market, offering riders enhanced connectivity and safety. To effectively position themselves in the market share race, manufacturers employ various strategies.

One prevalent strategy is differentiation through technological innovation. Companies invest heavily in research and development to introduce cutting-edge features that set their connected motorcycles apart. By offering unique and advanced functionalities, such as AI-powered ride assistance, predictive maintenance alerts, and seamless integration with smartphones, manufacturers can attract tech-savvy consumers who seek a blend of performance and connectivity. This differentiation not only caters to existing motorcycle enthusiasts but also draws in a broader audience that values the integration of smart technologies into their daily lives.

Collaboration with technology partners is another strategic avenue. Connected motorcycle manufacturers often form partnerships with established tech companies to leverage their expertise and broaden their product offerings. Integrating with leading navigation systems, communication platforms, or even collaborating on custom apps enhances the overall connected experience for riders. Such collaborations not only provide a competitive edge but also strengthen the brand's credibility, as consumers associate the motorcycle with reputable technology providers.

Furthermore, pricing strategies play a crucial role in market share positioning. While connected motorcycles boast advanced features, manufacturers must strike a balance between offering value for money and maintaining a competitive price point. Aggressive pricing can attract a larger consumer base, particularly among entry-level riders or those looking to upgrade from traditional motorcycles. On the other hand, a premium pricing strategy positions the connected motorcycle as a high-end, exclusive product, targeting enthusiasts who prioritize cutting-edge technology and are willing to pay a premium for it.

Market segmentation is another key aspect of market share positioning for connected motorcycles. Identifying and targeting specific customer segments with tailored marketing campaigns can be more effective than adopting a one-size-fits-all approach. For instance, manufacturers may focus on urban commuters by highlighting features like real-time traffic updates and smart navigation, or target adventure seekers with rugged designs and off-road capabilities. By understanding the diverse needs and preferences of different customer segments, manufacturers can create targeted messaging that resonates with specific demographics.

The market share positioning of connected motorcycles revolves around a multifaceted approach. Differentiation through technological innovation, collaboration with technology partners, strategic pricing, and market segmentation are integral elements in this competitive landscape. As the motorcycle industry continues to evolve with advancements in connectivity, manufacturers must adapt their strategies to not only capture market share but also to stay at the forefront of technological innovation and meet the ever-changing demands of the modern rider.

Leave a Comment