Few developments that occurred in recent times influencing the market growth of confectionery fillings are listed below

January 2025: Cargill divulged a new assortment of organic sweet paste fusions. According to the firm's news reports, they took the initiative to broaden their market by introducing a new line of fillings, which solely consisted of organic and clean ingredients that are certified; this addition was mainly targeted towards the rise in demand for organic ingredients in the clean-label market.

November 2024: Barry Callebaut's sustainable fillings range recently expanded. The company has pledged to spread its market outreach by stressing environmental Sustainability and appropriate practices when sourcing fillings for the confectionery industry.

September 2024: Ferrer revealed a new range of fillings heavily based on sugar-free confections. Ferrer addressed the consumer concern of higher sugar alternatives by offering a sugar-free line of chocolaty fillings amidst their recent product expansion.

December 2023: Ohm Food Ingredients has promised to work towards unveiling a range of fillings centered around fruits. The company offered to deliver a transitional change for the manufacturers by keeping aside the use of artificial flavors and sweeteners, emphasizing sweetness instead when working to make confectionery products.

June 2023: A new plant-based amalgamation was recently launched by Kerry Group for candy fillings. Kerry worked towards introducing an amalgamation suited for those preferring to stay from casting dairy into their candy fusions as a filling.

December 2022: Barry Callebaut started selling new kinds of premium chocolate fillings. The company has introduced chocolate fillings with various flavors and textures to help confectionery manufacturers set themselves apart.

September 2022: Olam Food Ingredients broadened its portfolio of natural fillings. Olam presented an extended range of fruit and nut systems while ensuring sustainable procurement and clean products for the confectionary sector.

Scope of the Report

Confectionery fillings Market, by Product Type

- Fruit Fillings

- Non-Fruit Fillings

- Nut-Based Fillings

Confectionery fillings Market, by Form

Confectionery fillings Market, by Category

- Water-Based

- Fat-Based

- Cocoa-Based

Confectionery fillings Market, by Application

- Chocolate

- Bakery

- Gummies

- Others

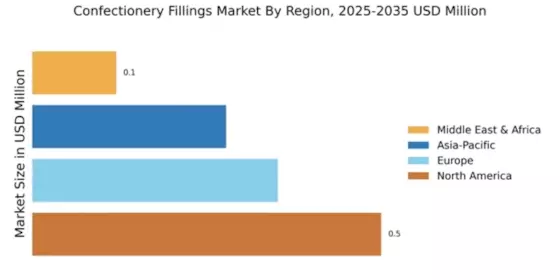

Confectionery fillings Market, by Region

- North America

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Belgium

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- Australia & New Zealand

- Malaysia

- Indonesia

- Thailand

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Intended Audience

Confectionery fillings Manufacturers

Chooclates Manufacturers

Bakery Manufacturers

Raw Material Suppliers

Retailers, Wholesalers, and Distributors

Governments, Associations, and Industrial Bodies

Investors and Trade Experts