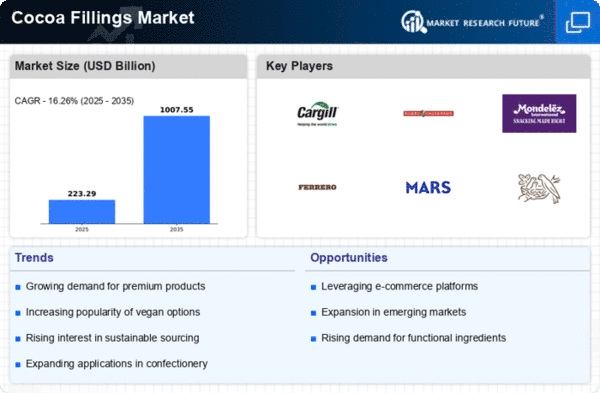

Market Growth Projections

The Global Cocoa Fillings Market Industry is projected to experience robust growth, with expectations to reach 1007.9 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 16.24% from 2025 to 2035. Such projections reflect the increasing integration of cocoa fillings in various food products, including baked goods and snacks. The expanding consumer base, coupled with rising disposable incomes, suggests a favorable environment for market expansion. As manufacturers continue to innovate and adapt to consumer preferences, the Global Cocoa Fillings Market Industry appears well-positioned for sustained growth in the coming years.

Expansion of E-commerce Channels

The rise of e-commerce has significantly impacted the Global Cocoa Fillings Market Industry, providing consumers with greater access to a variety of products. Online platforms enable manufacturers to reach a wider audience, facilitating the distribution of cocoa fillings across geographical boundaries. This trend is particularly pronounced in emerging markets, where traditional retail channels may be limited. As consumers increasingly turn to online shopping for convenience, the Global Cocoa Fillings Market Industry is poised for growth. The ability to offer personalized shopping experiences and targeted marketing strategies further enhances the appeal of cocoa fillings in the digital marketplace.

Innovation in Product Development

Innovation stands as a pivotal driver within the Global Cocoa Fillings Market Industry. Manufacturers are increasingly investing in research and development to create unique and diverse cocoa filling options. This includes the introduction of exotic flavors, textures, and combinations that appeal to a broader audience. For example, the incorporation of superfoods into cocoa fillings is gaining traction, aligning with consumer trends towards functional foods. Such innovations not only enhance the sensory experience but also cater to niche markets, thereby expanding the overall consumer base. This focus on product development is likely to propel the Global Cocoa Fillings Market Industry towards sustained growth.

Rising Demand for Confectionery Products

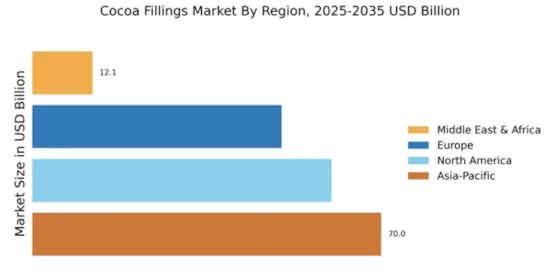

The Global Cocoa Fillings Market Industry experiences a surge in demand driven by the increasing consumption of confectionery products. As consumers seek indulgent treats, the market is projected to reach 192.6 USD Billion in 2024. This trend is particularly evident in regions such as North America and Europe, where chocolate-based products dominate. The growing popularity of premium chocolates and artisanal confectionery further fuels this demand. Manufacturers are responding by innovating with diverse cocoa fillings, catering to evolving consumer preferences. This shift not only enhances product offerings but also contributes to the overall growth trajectory of the Global Cocoa Fillings Market Industry.

Health Consciousness and Clean Label Trends

In recent years, there has been a notable shift towards health consciousness among consumers, influencing the Global Cocoa Fillings Market Industry. As individuals become more aware of their dietary choices, there is a growing preference for clean label products that contain natural ingredients. This trend is prompting manufacturers to reformulate cocoa fillings, reducing sugar content and incorporating healthier alternatives. For instance, the introduction of organic cocoa fillings aligns with consumer demands for transparency and quality. This evolving landscape suggests that the Global Cocoa Fillings Market Industry may witness a significant transformation as brands adapt to these health-oriented preferences.

Sustainability Initiatives in Cocoa Sourcing

Sustainability has emerged as a critical focus within the Global Cocoa Fillings Market Industry, driven by increasing consumer awareness and demand for ethically sourced ingredients. Manufacturers are adopting sustainable practices in cocoa sourcing, ensuring that their products align with environmental and social responsibility standards. This includes initiatives such as fair trade certifications and partnerships with local farmers. As consumers prioritize sustainability, brands that demonstrate a commitment to ethical sourcing are likely to gain a competitive edge. This shift not only enhances brand reputation but also contributes to the long-term viability of the Global Cocoa Fillings Market Industry.