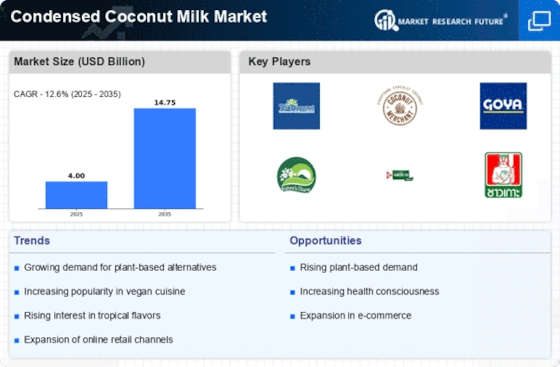

Condensed Coconut Milk Market Summary

As per Market Research Future analysis, the Condensed Coconut Milk Market Size was estimated at 3.998 USD Billion in 2024. The Condensed Coconut Milk industry is projected to grow from USD 4.501 Billion in 2025 to USD 14.75 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 12.6% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Condensed Coconut Milk Market is experiencing robust growth driven by evolving consumer preferences and innovative product offerings.

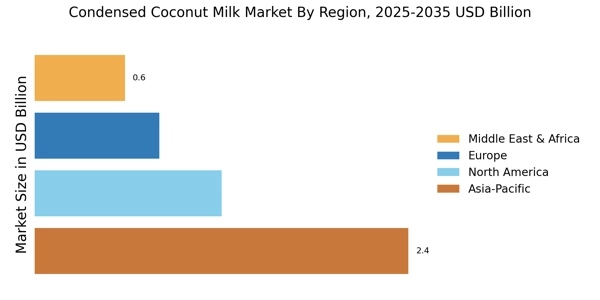

- The market is witnessing a rising demand for plant-based alternatives, particularly in North America, which remains the largest market.

- Innovation in product offerings is evident, with sweetened condensed coconut milk leading the segment, while skimmed varieties are gaining traction.

- Expansion of distribution channels is facilitating increased availability, especially in the Asia-Pacific region, recognized as the fastest-growing market.

- Health consciousness among consumers and the culinary versatility of condensed coconut milk are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 3.998 (USD Billion) |

| 2035 Market Size | 14.75 (USD Billion) |

| CAGR (2025 - 2035) | 12.6% |

Major Players

Thai Coconut Public Company Limited (TH), Coconut Merchant (PH), Goya Foods, Inc. (US), Nature's Charm (TH), Aroy-D (TH), Chaokoh (TH), Coconut Dream (US), Kara (SG), Tropicana (US)