Regulatory Frameworks

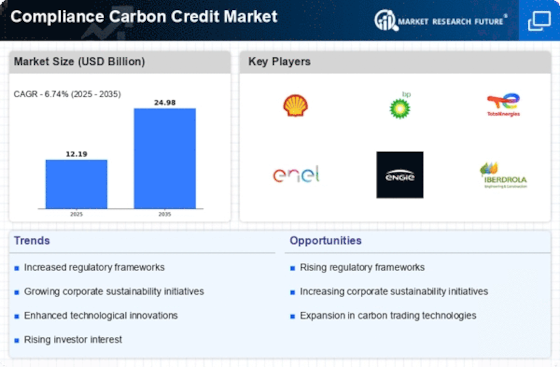

The Compliance Carbon Credit Market is heavily influenced by evolving regulatory frameworks that aim to mitigate climate change. Governments worldwide are implementing stricter emissions targets, which compel companies to participate in carbon credit trading. For instance, the European Union Emissions Trading System has set ambitious goals for reducing greenhouse gas emissions by 55% by 2030. This regulatory pressure creates a robust demand for compliance carbon credits, as companies seek to offset their emissions. Furthermore, the introduction of carbon pricing mechanisms incentivizes businesses to invest in cleaner technologies, thereby expanding the compliance carbon credit market. As regulations become more stringent, the market is likely to witness increased participation from various sectors, enhancing its overall growth potential.

Technological Advancements

Technological advancements play a crucial role in shaping the Compliance Carbon Credit Market. Innovations in carbon capture and storage technologies, as well as improvements in monitoring and verification processes, enhance the efficiency and transparency of carbon credit trading. For example, blockchain technology is being explored to create secure and transparent registries for carbon credits, which could streamline transactions and reduce fraud. Additionally, advancements in data analytics allow for more accurate emissions tracking, which is essential for compliance. As these technologies continue to evolve, they are likely to attract more participants to the compliance carbon credit market, thereby increasing its overall liquidity and effectiveness.

International Climate Agreements

International climate agreements significantly impact the Compliance Carbon Credit Market by establishing frameworks for emissions reduction commitments. Agreements such as the Paris Accord encourage countries to set nationally determined contributions (NDCs) aimed at reducing greenhouse gas emissions. These commitments often necessitate the use of compliance carbon credits to meet targets. As nations strive to fulfill their obligations under these agreements, the demand for carbon credits is likely to increase. Furthermore, the establishment of carbon markets in various countries can facilitate international trading of carbon credits, thereby enhancing market liquidity. The ongoing evolution of international climate agreements will continue to shape the compliance carbon credit market, influencing its growth trajectory.

Corporate Sustainability Initiatives

In recent years, the Compliance Carbon Credit Market has seen a surge in corporate sustainability initiatives. Many companies are adopting ambitious sustainability goals, aiming for net-zero emissions by 2050. This trend is driven by increasing consumer awareness and demand for environmentally responsible practices. According to recent data, over 1,500 companies have committed to science-based targets, which often include purchasing carbon credits to offset their emissions. This growing corporate responsibility not only boosts the demand for compliance carbon credits but also encourages innovation in sustainable practices. As more businesses recognize the importance of sustainability, the compliance carbon credit market is expected to expand, providing opportunities for investment and growth.

Market Volatility and Pricing Dynamics

The Compliance Carbon Credit Market is characterized by market volatility and complex pricing dynamics. Factors such as regulatory changes, economic conditions, and technological developments can lead to fluctuations in carbon credit prices. For instance, in 2023, the price of carbon credits in the European market experienced significant spikes due to tightening supply and increased demand from industries striving to meet compliance obligations. This volatility can create both challenges and opportunities for market participants. Companies may need to adopt strategic approaches to manage their carbon credit portfolios effectively. Understanding these pricing dynamics is essential for stakeholders looking to navigate the compliance carbon credit market successfully.