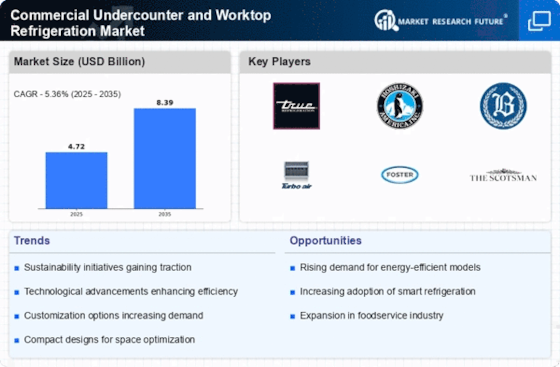

Rising Demand in Foodservice Sector

The Commercial Undercounter and Worktop Refrigeration Market is experiencing a notable surge in demand, particularly driven by the foodservice sector. As restaurants, cafes, and catering services expand, the need for efficient refrigeration solutions becomes paramount. According to recent data, the foodservice industry is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth is likely to fuel the demand for undercounter and worktop refrigeration units, which are essential for maintaining food safety and quality. Additionally, the trend towards quick-service restaurants and food trucks further emphasizes the necessity for compact and efficient refrigeration solutions. As such, manufacturers are increasingly focusing on developing innovative products that cater to the specific needs of this expanding market.

Increased Focus on Energy Efficiency

Energy efficiency has emerged as a critical driver within the Commercial Undercounter and Worktop Refrigeration Market. With rising energy costs and growing environmental concerns, businesses are seeking refrigeration solutions that minimize energy consumption. Recent studies indicate that energy-efficient refrigeration units can reduce operational costs by up to 30%, making them an attractive option for foodservice operators. Furthermore, regulatory bodies are implementing stricter energy efficiency standards, compelling manufacturers to innovate and produce more sustainable products. This shift not only benefits the environment but also aligns with the increasing consumer preference for eco-friendly practices. As a result, the market is witnessing a trend towards the development of advanced refrigeration technologies that prioritize energy efficiency while maintaining optimal performance.

Growing Trend of Food Safety Regulations

The Commercial Undercounter and Worktop Refrigeration Market is being shaped by the growing trend of stringent food safety regulations. Governments and health organizations worldwide are implementing more rigorous standards to ensure food safety, which directly impacts refrigeration requirements. Compliance with these regulations necessitates the use of reliable refrigeration systems that can maintain appropriate temperatures and prevent foodborne illnesses. As a result, foodservice operators are investing in high-quality undercounter and worktop refrigeration units that meet these standards. Market data indicates that the demand for compliant refrigeration solutions is likely to increase as more businesses recognize the importance of adhering to food safety regulations. This trend not only enhances consumer trust but also drives the need for innovative refrigeration technologies that ensure compliance.

Technological Advancements in Refrigeration

Technological advancements are significantly influencing the Commercial Undercounter and Worktop Refrigeration Market. The integration of smart technology, such as IoT-enabled refrigeration units, is transforming how businesses manage their refrigeration needs. These innovations allow for real-time monitoring and control, enhancing operational efficiency and reducing waste. Data suggests that the adoption of smart refrigeration solutions can lead to a reduction in food spoilage by up to 20%, which is particularly beneficial for the foodservice sector. Additionally, advancements in insulation materials and compressor technology are improving the overall performance and reliability of refrigeration units. As businesses increasingly prioritize efficiency and sustainability, the demand for technologically advanced refrigeration solutions is expected to rise, further propelling market growth.

Customization and Versatility in Product Offerings

Customization and versatility are becoming increasingly important in the Commercial Undercounter and Worktop Refrigeration Market. As businesses seek to optimize their kitchen spaces, the demand for refrigeration solutions that can be tailored to specific needs is on the rise. Manufacturers are responding by offering a range of customizable options, including different sizes, configurations, and features. This trend is particularly evident in the foodservice sector, where operators require refrigeration units that fit seamlessly into their unique workflows. Market analysis suggests that the ability to customize refrigeration solutions can enhance operational efficiency and improve overall customer satisfaction. As such, the focus on versatile product offerings is likely to continue driving growth in the market, as businesses increasingly prioritize solutions that align with their specific operational requirements.