Top Industry Leaders in the Commercial Refrigeration Equipment Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the industry are:

- Williams Refrigeration

- EPTA

- Rockwell Industries Limited

- Voltas, Inc.

- Kysor Warren

- A Dover Company

- Hillphoenix

- The kelvin group

- Hussmann Corporation

- Enex Technologies

- AHT Cooling Systems GmbH

- United Technologies Corporation among others.

The Chilling Competition: Navigating the Commercial Refrigeration Landscape

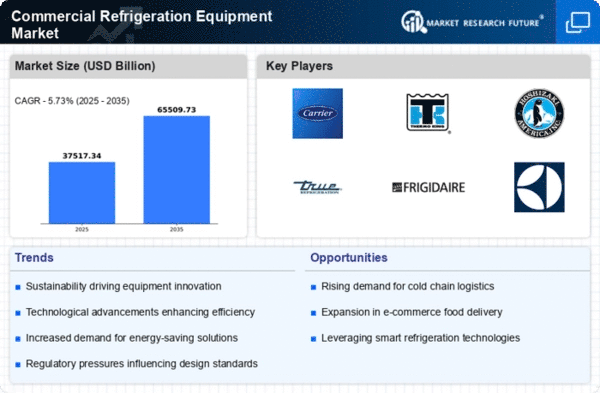

The commercial refrigeration market, expected to reach a cool $43.3 billion by 2026, is a bustling scene where established players fight for shelf space amidst the rise of nimble innovators and evolving customer needs. Understanding the strategies powering this frosty fight, the factors defining market share, and emerging trends is crucial for keeping your chill and thriving in this dynamic environment.

Key Players and their Strategies:

- Global Gladiators: Giants like Carrier Commercial Refrigeration and Emerson Electric Company leverage their expansive footprints, diverse product portfolios, and brand recognition to command a significant market share. Carrier caters to a wide range of applications with comprehensive equipment lines, while Emerson focuses on energy-efficient solutions with its Copeland scroll compressors.

- Regional Specialists: Companies like Voltas, Inc. and Kysor Warren dominate specific geographies by tailoring solutions to regional regulations and climate needs. Voltas excels in cost-effective equipment for India's hot climate, while Kysor Warren caters to North America's stringent hygiene standards.

- Technological Trailblazers: Startups like Enex Technologies and AHT Cooling Systems GmbH are shaking things up with innovative approaches. Enex focuses on smart technologies like cloud-based monitoring and remote diagnostics, while AHT pushes the boundaries of energy efficiency with natural refrigerant-based systems.

Factors for Market Share Analysis:

- Product Breadth and Depth: Offering a variety of equipment for diverse applications – display cabinets, reach-in freezers, walk-in coolers – expands market reach and attracts varied customer segments.

- Technological Innovation: Integrating advanced technologies like smart controls, remote monitoring, and natural refrigerants enhances reliability, energy efficiency, and environmental appeal.

- Cost-Effectiveness and ROI: Balancing advanced features with affordability is crucial, especially in budget-conscious segments. Voltas' cost-effective equipment has propelled its market share in emerging economies.

- Sustainability Focus: Reducing energy consumption and using eco-friendly refrigerants is gaining traction. AHT's natural refrigerant systems resonate with sustainability-conscious buyers.

Emerging Trends and Company Strategies:

- Smart Refrigeration: Integrating sensors, communication modules, and AI into equipment enables real-time performance monitoring, predictive maintenance, and data-driven energy optimization. Enex's cloud-based solutions exemplify this trend.

- Modular and Scalable Solutions: Offering modular equipment configurations that can be easily added to or rearranged facilitates flexibility and future-proofing installations. Carrier's modular display cabinets cater to this need.

- Focus on Food Safety and Hygiene: Maintaining optimal temperature control and ensuring sanitary conditions is paramount. Kysor Warren's equipment with advanced hygiene features addresses this growing demand.

- Focus on Specific Segments: Targeting high-growth segments like supermarkets, convenience stores, and restaurants with tailored solutions is a growing trend. Emerson's Copeland compressors cater specifically to supermarket refrigeration needs.

Overall Competitive Scenario:

The commercial refrigeration market is a fiercely contested space, where traditional giants face challenges from regional champions and technology-driven startups. Success hinges on continuous innovation, a diversified product portfolio, and agility in adapting to customer needs and emerging trends. Companies prioritizing smart technologies, modularity, sustainability, and sector-specific solutions hold a strong hand in this dynamic landscape.

Latest Company Updates:

October 2023- Energy Recovery, Inc. on October 20 disclosed a current member of the Energy Recovery Board of Directors, Mr. David Moon, has been assigned temporary Chief Executive Officer, effective instantly. Mr. Bob Mao will stay an associate of the Board, and Ms. Pamela Tondreau, the current Lead Independent Director, has been chosen as the newfound Chairperson of the Board. A thorough search procedure to recognize a permanent President and Chief Executive Officer, which involves internal and external applicants, has been proceeding with the help of a managing executive search firm. Ms. Tondreau said that the Board has a strong view of Energy Recovery's long-term capability and is sure Mr. Moon is the correct choice as the leader for this moment of transition, coupled with the remaining team.

October 2023- The U.S. Environmental Protection Agency (EPA) revealed its latest actions to phase down climate-damaging HFCs on October 6 as per the American Innovation and Manufacturing (AIM) Enactment, revealing a concluding law to boost up the present transformation to more climate-safe and efficient technologies in modern refrigeration, cooling and heating systems and other products by limiting the utilization of HFCs where substitutes are already available. The concluding rule sanctions HFCs in some new equipment and puts a restriction on the GWP of the HFCs that can be utilized in every subsector, with conformity dates varying from 2025 to 2028. It lines up carefully with various requests to repeat California's HFC limitations by putting GWP limits of 150 for various refrigeration applications and 700 for air conditioning and heat pumps. The California policies have provoked a considerable uptick in the utilization of natural refrigerant-based substitutes such as hydrocarbon cabinets and transcritical CO2 (R744) systems in supermarkets in that state. The regulation directs to both imported and domestically produced products, which will assist in making a level playing field for American organizations that are already transitioning to HFC alternatives, as per the statement released by the EPA.