Rising Energy Costs

The increasing cost of traditional energy sources is a primary driver for the Commercial And Industrial Solar PV Module Market. As energy prices continue to rise, businesses are seeking alternative solutions to mitigate expenses. Solar PV modules offer a viable option, allowing companies to generate their own electricity and reduce reliance on grid power. In many regions, the cost of solar energy has become competitive with conventional energy sources, making it an attractive investment. According to recent data, the levelized cost of electricity from solar has decreased significantly, which further incentivizes businesses to adopt solar technology. This trend is likely to continue, as energy costs are projected to rise, thereby enhancing the appeal of solar PV solutions.

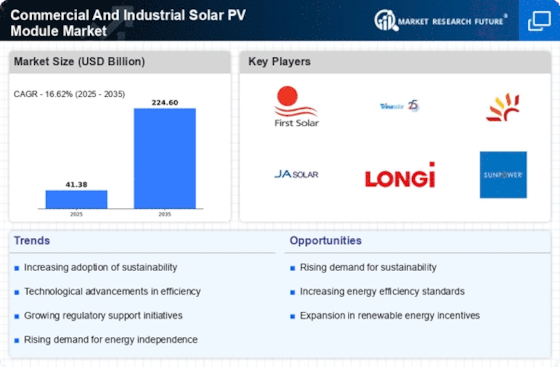

Technological Innovations

Technological innovations in solar PV technology are significantly influencing the Commercial And Industrial Solar PV Module Market. Advancements in solar panel efficiency, energy storage solutions, and smart grid technologies are enhancing the overall performance and reliability of solar systems. For instance, the development of bifacial solar panels, which capture sunlight on both sides, has led to increased energy generation. Additionally, improvements in battery storage technology allow businesses to store excess energy for use during peak demand periods. These innovations not only improve the economic viability of solar installations but also expand their applicability across various sectors. As technology continues to evolve, it is likely that the market will witness further enhancements, making solar energy an even more attractive option for commercial and industrial users.

Corporate Sustainability Goals

The increasing emphasis on corporate sustainability goals is a significant driver for the Commercial And Industrial Solar PV Module Market. Many companies are now integrating sustainability into their core business strategies, aiming to reduce their carbon footprints and enhance their environmental stewardship. The adoption of solar PV technology aligns with these objectives, as it provides a clean energy source that can substantially lower greenhouse gas emissions. Recent surveys indicate that a considerable percentage of businesses are committing to renewable energy targets, with many aiming for 100% renewable energy by 2030. This shift not only reflects a growing awareness of environmental issues but also positions companies favorably in the eyes of consumers and investors, thereby driving demand for solar solutions.

Government Incentives and Subsidies

Government incentives and subsidies play a crucial role in promoting the Commercial And Industrial Solar PV Module Market. Various governments have implemented policies aimed at encouraging the adoption of renewable energy technologies. These incentives can take the form of tax credits, grants, or rebates, which significantly lower the initial investment required for solar installations. For instance, in several regions, businesses can benefit from investment tax credits that cover a substantial percentage of the installation costs. This financial support not only makes solar more accessible but also enhances the return on investment for companies. As governments continue to prioritize renewable energy, the availability of such incentives is expected to grow, further driving market expansion.

Increasing Demand for Energy Independence

The growing demand for energy independence is a notable driver for the Commercial And Industrial Solar PV Module Market. Businesses are increasingly recognizing the risks associated with energy supply disruptions and price volatility. By investing in solar PV systems, companies can achieve a degree of energy autonomy, reducing their vulnerability to external energy market fluctuations. This trend is particularly evident in regions where energy security is a concern. Furthermore, as energy independence becomes a strategic priority for many organizations, the adoption of solar technology is expected to rise. The ability to generate electricity on-site not only enhances operational resilience but also contributes to long-term cost savings, making solar PV an appealing choice for businesses seeking stability in their energy supply.