Consumer Awareness and Preferences

Consumer awareness regarding vehicle safety is a crucial factor influencing the Collision Sensors Market. As individuals become more informed about the benefits of collision sensors, their preferences are shifting towards vehicles equipped with these technologies. Surveys indicate that a substantial percentage of consumers prioritize safety features when purchasing a vehicle, which drives manufacturers to incorporate advanced collision sensors into their designs. This growing consumer demand is likely to stimulate competition among automakers, further propelling the Collision Sensors Market. As manufacturers strive to meet these preferences, the market is expected to witness robust growth in the coming years.

Government Regulations and Standards

Government regulations play a pivotal role in shaping the Collision Sensors Market. Various countries have implemented stringent safety standards that mandate the inclusion of collision sensors in new vehicles. For instance, regulations requiring advanced driver-assistance systems (ADAS) are becoming more prevalent, compelling manufacturers to adopt collision sensor technologies. This regulatory landscape not only enhances vehicle safety but also stimulates market growth, as compliance with these standards necessitates investment in innovative sensor solutions. The Collision Sensors Market is thus likely to expand as manufacturers adapt to these regulatory requirements, ensuring that their vehicles meet the necessary safety benchmarks.

Increased Adoption of Autonomous Vehicles

The rise of autonomous vehicles is a key driver for the Collision Sensors Market. As the automotive sector shifts towards automation, the need for reliable collision detection systems becomes paramount. Autonomous vehicles rely heavily on collision sensors to navigate safely and avoid accidents. Market analysts predict that the increasing adoption of autonomous driving technology will significantly boost the demand for collision sensors. This trend is expected to create new opportunities within the Collision Sensors Market, as manufacturers develop specialized sensors tailored for autonomous applications, thereby enhancing vehicle safety and performance.

Rising Demand for Vehicle Safety Features

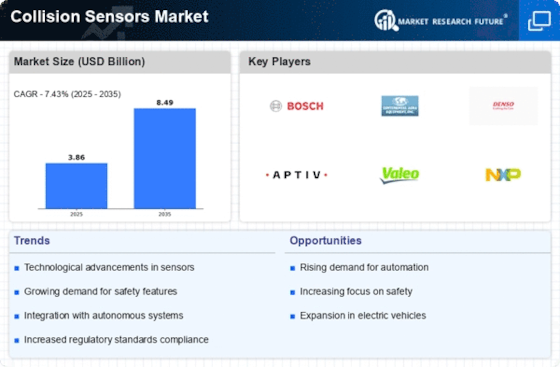

The Collision Sensors Market is experiencing a notable surge in demand for advanced vehicle safety features. As consumers become increasingly aware of road safety, manufacturers are compelled to integrate collision sensors into their vehicles. This trend is further supported by data indicating that vehicles equipped with collision sensors can reduce accident rates by up to 30%. Consequently, automakers are investing heavily in research and development to enhance sensor technology, which is expected to drive market growth. The increasing emphasis on safety regulations and consumer preferences for safer vehicles is likely to propel the Collision Sensors Market forward, as manufacturers strive to meet these evolving demands.

Technological Innovations in Sensor Technology

Technological innovations are significantly influencing the Collision Sensors Market. The advent of advanced sensor technologies, such as LiDAR and radar systems, has revolutionized the way vehicles detect potential collisions. These innovations enhance the accuracy and reliability of collision detection, thereby improving overall vehicle safety. Market data suggests that the integration of these advanced technologies could lead to a projected growth rate of over 15% in the Collision Sensors Market over the next five years. As manufacturers continue to invest in cutting-edge sensor technologies, the market is poised for substantial expansion, driven by the demand for more sophisticated safety features.