Market Share

Introduction: Navigating the Competitive Landscape of Collaborative Robotics

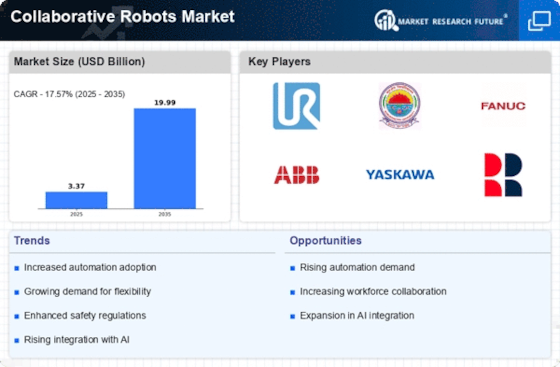

The market for so-called ‘collaborative robots’ is currently experiencing a boom, driven by the fast take-up of technology, changing legislation, and the growing demand for automation and productivity. Leading players such as robot manufacturers, IT service companies, and artificial intelligence start-ups are now battling for market leadership with advanced capabilities such as artificial intelligence-based analytics, IoT solutions, and automation solutions. The robot manufacturers focus on improving the robots’ versatility and ease of integration, while the IT service companies are concentrating on seamless connectivity and data management. Artificial intelligence start-ups, on the other hand, are bringing in new solutions based on artificial intelligence and green ICT, focusing on the priorities of productivity and efficiency. As regional growth prospects improve, especially in North America and Asia-Pacific, strategic deployment trends are shifting towards more advanced applications in manufacturing, logistics, and health care, enabling companies to take advantage of the transformative potential of co-robots in the years ahead.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions that integrate collaborative robots into broader automation systems.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| ABB | Strong global presence and diverse offerings | Industrial automation and robotics | Global |

| KUKA | Innovative robotics technology and automation expertise | Robotics and automation solutions | Global |

| FANUC | Leading in robotics and AI integration | Industrial robots and automation | Global |

| Yaskawa Electric | Expertise in motion control and robotics | Robotics and automation systems | Global |

Specialized Technology Vendors

These vendors focus on specific technologies or applications within the collaborative robotics space.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Universal Robots | Pioneers in user-friendly collaborative robots | Collaborative robotic arms | Global |

| Techman Robot | Integrated vision systems in cobots | Collaborative robots with vision capabilities | Global |

| Rethink Robotics | Focus on adaptive and easy-to-program robots | Collaborative robotics for manufacturing | North America, Europe |

Infrastructure & Equipment Providers

These vendors provide essential components and systems that support collaborative robots.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Denso Wave | Expertise in automation and robotics components | Robotic systems and components | Asia, Global |

| Omron | Integration of sensing and control technologies | Automation and robotics solutions | Global |

| Staubli Robotics | High precision and reliability in robotics | Industrial and collaborative robots | Global |

Emerging Players & Regional Champions

- UR (Denmark): Specializes in easy-to-use, light, collaborative robots, designed for small and medium-sized companies. Recently, it has landed several contracts with European auto suppliers, thereby strengthening its position in the automotive industry. It is challenging the established suppliers by offering cost-effective, easily integrated solutions.

- The following is a list of industrial robots and robot systems. This company has been recently engaged in improving the production processes of a large manufacturer of electric and electronic equipment. Its products complement the offerings of established robot manufacturers by providing supplementary software that makes their robots more usable.

- Techman (Taiwan): They are famous for integrating vision systems into their robots, enabling them to perform more complex tasks. They have recently installed their robots in food packaging and in the assembly of electrical appliances. They compete with the big players, offering a wide range of advanced automation features.

- Dürr (Germany): Dürr is a company that manufactures automation systems for the automobile industry. It specializes in automation solutions for the assembly line, including co-bots. Recently it received a contract to automate a large automobile plant in Germany. They complement the offerings of the major automation suppliers by providing specialized automation solutions for the automobile industry.

- Mujin (Japan) develops high-level robot software that allows collaborative robots to perform complex tasks in logistics and warehouses. They have recently implemented their solution in a major e-commerce warehouse and the result was a significant increase in productivity. They are taking on the big robot manufacturers with their cutting-edge AI-based solutions.

Regional Trends: North America and Europe will see a significant increase in the use of these robots by 2024, owing to the automation of manufacturing and distribution. But the Asia-Pacific region is gaining in importance, especially in Japan and China, which are making considerable investments in this technology. Companies are specialising in particular applications such as food, electronics, and the car industry, thereby increasing competition.

Collaborations & M&A Movements

- Universal Robots and Techman Robot have announced a partnership in which they will combine their respective technologies in order to provide automation solutions for small and medium-sized enterprises, and thereby strengthen their position in the growing market for cooperative robots.

- ABB acquired the robotics division of a leading automation firm in early 2024 to expand its portfolio of collaborative robots, positioning itself as a market leader amidst increasing demand for automation in manufacturing.

- KUKA and NVIDIA entered into a collaboration to develop AI-driven collaborative robots, focusing on improving machine learning capabilities, which is expected to significantly enhance their market share in the industrial automation sector.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| AI-Powered Ops Mgmt | Universal Robots, KUKA, FANUC | Artificial intelligence is now a part of the Universal Robots' operation, which makes it possible to make adjustments to the production line in real time. Kuka robots use machine learning to optimize their work. This is demonstrated by Kuka's partnership with car manufacturers. FANUC's AI system allows for preventive maintenance, which greatly reduces the downtime of the robot. |

| Ease of Programming | ABB, Yaskawa, Rethink Robotics | The ABB graphical programming language allows non-specialists to easily program robots for various applications. It is widely used in the factory automation industry. Sawyer is a human-like robot with intuitive, teach-and-repeat programming, which increases its accessibility. |

| Safety Features | UR, KUKA, Omron | Collaborative robots are equipped with a number of safety devices, which allow them to work safely with people without a safety cage. The robots from KUKA are equipped with highly sensitive sensors for collision detection, which allow them to work safely even in dynamic surroundings. The high safety standards of the robots from Omron are also well known in the health care sector, where they assist in the treatment of patients. |

| Payload Capacity | FANUC, KUKA, MOTOMAN | The Fanuc range of heavy-duty cobots is suitable for applications requiring high payloads. The KUKA LBR iiwa is capable of handling payloads of up to 14 kg, which makes it suitable for a wide variety of applications. The Motoman range of heavy-duty robots is designed for industrial applications requiring high payloads, and is at its best in the manufacturing sector. |

| Integration with IoT | Siemens, Rockwell Automation, ABB | INTEGRATION: IoT solutions from Siemens are easily integrated with the robots, thereby enhancing the data analysis. FactoryTalk from Rockwell Automation monitors and controls the robots in real time. ABB robots are IoT-ready, enabling remote diagnostics and monitoring of performance. |

Conclusion: Navigating the Collaborative Robots Landscape

The market for collaborative robots will be highly fragmented by 2024. In terms of regions, North America and Europe will continue to be the main markets for these robots, largely because of the growing interest in artificial intelligence and automation. But to take advantage of this market, vendors will need to strategically position themselves, relying on their flexibility and scalability to meet diverse customer needs. The major players are developing their offerings through acquisitions and alliances, while new entrants are focusing on niche applications and emerging technologies. The ability to integrate artificial intelligence, offer automated solutions and maintain operational flexibility will be the key to success in this evolving market.

Leave a Comment