Cold Chain Packaging Market Summary

As per Market Research Future analysis, The Global Cold Chain Packaging Market was estimated at 28.1 USD Billion in 2024. The cold chain packaging industry is projected to grow from 31.2 USD Billion in 2025 to 89.4 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 11.1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Cold Chain Packaging Market is poised for substantial growth driven by sustainability and technological advancements.

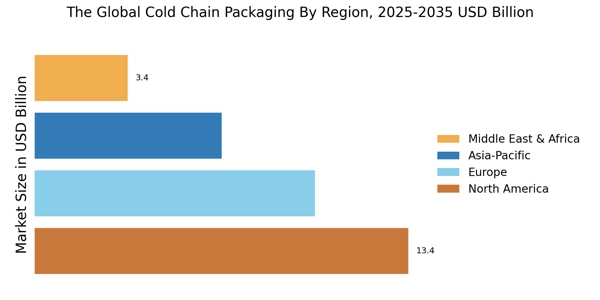

- North America remains the largest market for cold chain packaging, driven by robust e-commerce activities and stringent food safety regulations.

- Asia-Pacific is emerging as the fastest-growing region, fueled by increasing demand for perishable goods and rapid urbanization.

- EPS containers dominate the market as the largest segment, while vacuum insulated panels are gaining traction as the fastest-growing segment.

- Key market drivers include rising e-commerce activities and increasing consumer awareness of food safety, particularly in the food and pharmaceutical sectors.

Market Size & Forecast

| 2024 Market Size | 28.1 (USD Billion) |

| 2035 Market Size | 89.4 (USD Billion) |

| CAGR (2025 - 2035) | 11.1% |

Major Players

Thermo Fisher Scientific (US), Sonoco Products Company (US), Cold Chain Technologies (US), Pelican BioThermal (US), va-Q-tec AG (DE), CSafe Global (US), Envirotainer (SE), Sofrigam (FR), Cryopak (US)