Rising Self-Medication Trends

The trend towards self-medication is becoming increasingly pronounced, influencing the Cold and Flu Drugs Market significantly. Consumers are increasingly opting for over-the-counter medications to manage their symptoms without the need for a prescription. This shift is driven by a growing awareness of available products and the convenience they offer. Market data suggests that self-medication can lead to a more proactive approach to health, with individuals seeking immediate relief from cold and flu symptoms. As a result, the Cold and Flu Drugs Market is likely to benefit from this trend, as more consumers turn to readily available medications. This behavior may also encourage pharmaceutical companies to innovate and diversify their product offerings to meet the evolving needs of self-medicating consumers.

Expansion of E-commerce Platforms

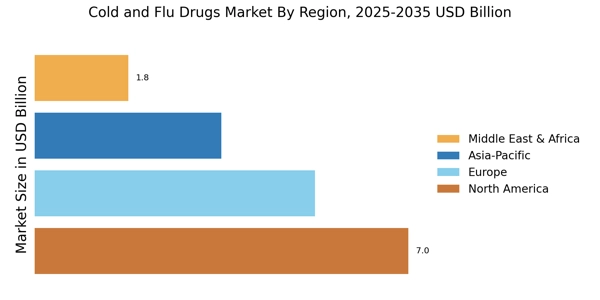

The expansion of e-commerce platforms is transforming the Cold and Flu Drugs Market by providing consumers with greater access to a wide range of products. Online shopping has become increasingly popular, allowing individuals to purchase cold and flu medications conveniently from their homes. This trend is particularly relevant in regions where access to physical pharmacies may be limited. Market data suggests that e-commerce sales of over-the-counter medications are on the rise, driven by the convenience and competitive pricing offered by online retailers. As more consumers turn to digital platforms for their healthcare needs, the Cold and Flu Drugs Market is likely to see a significant shift in purchasing behavior, necessitating adaptations from traditional retailers.

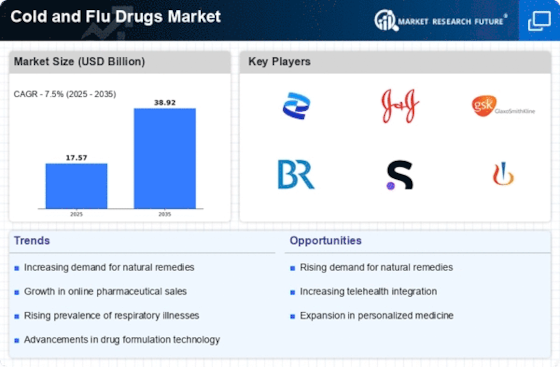

Increase in Respiratory Infections

The prevalence of respiratory infections, particularly during seasonal changes, appears to be a primary driver for the Cold and Flu Drugs Market. Data indicates that respiratory infections account for a substantial portion of healthcare visits, with millions affected annually. This surge in infections necessitates the availability of effective cold and flu medications, thereby propelling market growth. The Cold and Flu Drugs Market is likely to experience heightened demand during peak seasons, as consumers seek relief from symptoms. Furthermore, the increasing awareness of the importance of treating these infections promptly may lead to a rise in over-the-counter drug sales, further stimulating market dynamics. As healthcare systems continue to address these infections, the Cold and Flu Drugs Market is poised for sustained expansion.

Increased Health Awareness and Education

The growing emphasis on health awareness and education is significantly impacting the Cold and Flu Drugs Market. As consumers become more informed about the symptoms and treatment options for cold and flu, they are more likely to seek appropriate medications. Public health campaigns and educational initiatives are contributing to this trend, encouraging individuals to recognize the importance of timely treatment. Consequently, the Cold and Flu Drugs Market is experiencing a shift towards more informed purchasing decisions, with consumers actively seeking effective remedies. This heightened awareness may also lead to increased demand for preventive measures, such as vaccines and supplements, further influencing market dynamics.

Technological Advancements in Drug Development

Technological advancements in drug development are playing a crucial role in shaping the Cold and Flu Drugs Market. Innovations in formulation techniques and delivery systems are enhancing the efficacy and safety profiles of cold and flu medications. For instance, the introduction of novel drug delivery methods, such as nanotechnology, is enabling more targeted and effective treatments. Market analysis indicates that these advancements not only improve patient outcomes but also drive consumer confidence in over-the-counter products. As pharmaceutical companies invest in research and development, the Cold and Flu Drugs Market is likely to witness a surge in new product launches, catering to diverse consumer needs and preferences.