Market Analysis

In-depth Analysis of Co Fired Ceramic Market Industry Landscape

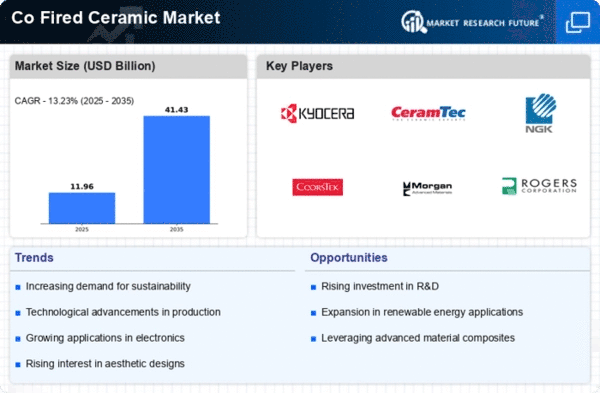

The dynamics of the market of co-fired ceramics industry with a set of complex intertwined factors that play a part in how the industry evolves and performs are depicted. Cofired ceramics, also called multilayer ceramics, have now gained a remarkable foothold in the market thanks to their unique characteristics and diverse applications including electronics, automotive electrical, and healthcare fields. Miniaturization of electronic parts is mainly due to the fact that they find wide application in various internal and drive systems of various equipment and, hence, it is directly connected to growing demand for these components. With even the most primitive electronics devices capable of not only shrinking in size but also becoming more advanced, there has now been a need to add compact, yet functional co-fired ceramics into their next generation of devices.

Further, the firing state of the automing industry has become the most important consumer of co-fired ceramics, for creating the sensors, actuators, and other critical components. Along with growing preference for electric vehicles, and the incorporation of advanced driver assistance systems (ADAS), this significant have attracted demand for this for this category. Ceramicization accomplishes thermal stability, mechanical strength, as well as operating condition harmonization which are prerequisites for the use of the materials in automobile industries.

Such co-fired ceramics also have great significance in electronics and automobile sectors but have also been used in the medical field. The growing trend towards how these medical equipment has diminution while still being biocompatible has created a huge demand for co-fired ceramics. Medical ceramics are used in manufacturing of modules for diagnostic mechanism and with other implants and sensors.

While co-fired ceramics markets also have some dynamic concerns that could result in hindrances to their growth, there are also some positives that might cause the industry to flourish. The cost of the most common raw materials, like ceramic and metal, may come out as a factor in the manufacturing cost, which, consequently, will consequent how much the ceramic product will retail to their consumers. Furthermore, there are economic conditions external to the sector which may influence the amount of global consumption, as variations in the macroeconomic statuses of countries may affect the purchasing of such technological devices and automobile goods.

Technological progress and innovations have a dynamic impact on the market condition of co-fired batteries. Repeated improvement, inspiration, and innovation in the design room are features contributing to the latest composite materials and production methods being widely applied in firing ceramic products. Ceramics manufacturers sustain ongoing research and development to create new ceramics with better electrical and thermal properties for the industries which are experiencing serious technical advancement every year.

Furthermore, such competition helps shaping the market trends, as companies attempt to set themselves apart from the competitors by means of innovative products, quality, and efficiency. Often, shared strategic association and partnership is a way to combat the effects of the competitors as the players seek to expand their market area and product catalogs.

Leave a Comment