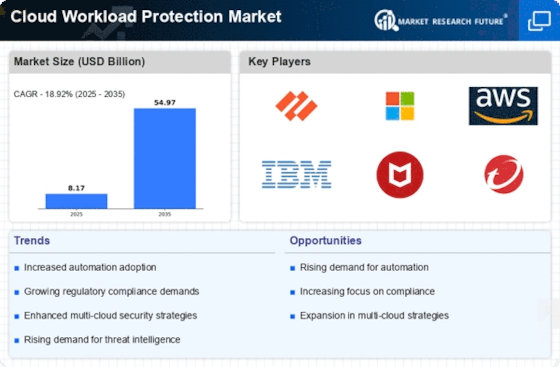

Top Industry Leaders in the Cloud Workload Protection Market

Navigating the Cloud Workload Protection Maze: A Competitive Landscape Analysis

The cloud has become the new battleground for security, with cyber threats evolving as rapidly as cloud adoption. The Cloud Workload Protection Market, safeguarding the ever-expanding universe of cloud workloads. This analysis delves into the key players, their strategies, and the factors shaping this dynamic market.

Key Players:

- Micro Incorporated (Japan)

- Guardicore (Israel)

- Symantec Corporation (US)

- McAfee Inc. (US)

- Sophos Ltd (UK)

- CLOUDPASSAGE (US)

- DOME9 SECURITY INC. (Israel)

Security Software Giants:

-

McAfee Cloud Workload Security: Delivers multi-layered protection for diverse cloud platforms, including endpoint protection, data loss prevention, and malware detection. Their strength lies in broad platform coverage and a strong brand reputation. -

Symantec Cloud Workload Protection: Combines intrusion detection, vulnerability management, and data security solutions for cloud workloads. They compete through comprehensive product suite and extensive experience in enterprise security. -

Palo Alto Networks Prisma Cloud: Provides cloud native security platform with workload protection, container security, and API security features. Their competitive edge lies in next-generation security architecture and focus on automation.

New and Emerging Players:

-

Acronis Cyber Protect Cloud: Integrates backup, disaster recovery, and anti-malware functionalities into a unified cloud workload protection platform. Their differentiation lies in combining data protection with security, addressing both security and business continuity needs. -

CloudHealth by Check Point: Focuses on securing multi-cloud deployments with real-time threat detection, compliance management, and cloud resource optimization. Their strategy emphasizes cloud-native development and agnostic platform support. -

Deepwatch: Utilizes AI and machine learning to automate workload protection and detect advanced threats. Their competitive advantage lies in their innovative approach and focus on proactive threat hunting.

Factors for Market Share Analysis:

-

Technology Breadth and Depth: CWP solutions offer diverse functionalities like malware detection, vulnerability management, and container security. Players with comprehensive feature sets catering to various needs will gain traction. -

Cloud Platform Specificity: Native integration with specific cloud platforms (e.g., Azure, AWS, GCP) provides a seamless user experience and performance advantage. Players with strong platform partnerships will have an edge. -

Threat Intelligence and Automation: Real-time threat intelligence, automated incident response, and proactive threat hunting capabilities are crucial for effective CWP. Players with advanced threat detection and response systems will stand out. -

Compliance and Data Security: Compliance with industry regulations and stringent data security measures are vital for enterprises. CWP solutions with robust compliance and data protection features will attract regulated industries.

Current Company Investment Trends:

-

Focus on AI and Machine Learning: Companies are heavily investing in AI and ML algorithms to enhance threat detection, incident response, and workload optimization. This trend fosters automation and improves security effectiveness. -

Consolidation and Acquisitions: Strategic acquisitions and partnerships are shaping the market landscape, with established players acquiring niche capabilities and startups expanding their portfolio. -

Open-source Security Platforms: Open-source CWP solutions are gaining traction as they offer flexibility, customization, and cost-effectiveness. Companies are collaborating on open-source projects to drive greater security adoption. -

DevSecOps Integration: CWP solutions are increasingly integrating with DevOps workflows to enable continuous security throughout the software development lifecycle. This trend strengthens security posture and eliminates silos.

Latest Company Updates:

-

McAfee Bolsters Cloud Security Portfolio: McAfee acquired CloudStrike, a leading cloud workload security provider, for USD 2.1 billion to strengthen its cloud security offerings. -

Palo Alto Networks Expands Cloud Footprint: Palo Alto Networks announced the availability of its Prisma Cloud platform on Google Cloud Platform (GCP), expanding its reach to multi-cloud environments. -

VMware Partners with Crowdstrike: VMware and Crowdstrike announced a strategic partnership to deliver integrated workload protection solutions for hybrid and multi-cloud environments.