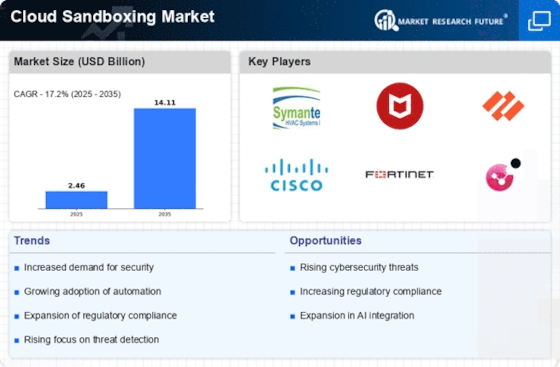

Rising Cybersecurity Threats

The Cloud Sandboxing Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations are increasingly recognizing the necessity of proactive security measures to safeguard sensitive data and systems. In 2025, it is estimated that cybercrime will cost businesses over 10 trillion dollars annually, prompting a shift towards advanced security solutions. Cloud sandboxing provides a controlled environment for testing and analyzing potentially harmful software, thereby mitigating risks before they can impact operational integrity. This trend indicates a growing reliance on cloud-based security solutions, as businesses seek to enhance their cybersecurity posture and protect against evolving threats.

Increased Cloud Adoption Across Industries

The Cloud Sandboxing Market is benefiting from the widespread adoption of cloud technologies across various sectors. As organizations migrate to cloud-based infrastructures, the need for effective security measures becomes paramount. In 2025, the cloud computing market is expected to surpass 500 billion dollars, driving demand for innovative security solutions like cloud sandboxing. This technology allows organizations to test and validate applications in a secure environment, reducing the risk of deploying untested software. The trend indicates that as more businesses transition to the cloud, the demand for cloud sandboxing solutions will likely continue to grow.

Demand for Cost-Effective Security Solutions

The Cloud Sandboxing Market is increasingly driven by the demand for cost-effective security solutions. Organizations are seeking ways to enhance their cybersecurity measures without incurring prohibitive costs. Cloud sandboxing offers a scalable solution that allows businesses to test and analyze software in a secure environment, reducing the need for extensive on-premises infrastructure. As companies look to optimize their security budgets, the adoption of cloud-based solutions is likely to rise. The market for cloud security solutions is expected to grow significantly, with estimates suggesting a value of over 70 billion dollars by 2027. This trend indicates that organizations are prioritizing cost efficiency while maintaining robust security measures.

Growing Need for Compliance and Data Privacy

As regulatory frameworks surrounding data privacy become more stringent, the Cloud Sandboxing Market is witnessing heightened interest. Organizations are compelled to comply with regulations such as GDPR and CCPA, which necessitate robust data protection strategies. Cloud sandboxing offers a means to test applications and software in a secure environment, ensuring compliance with these regulations. The market for compliance-related technologies is projected to reach 30 billion dollars by 2026, underscoring the importance of integrating compliance measures into cybersecurity strategies. This trend suggests that businesses are increasingly prioritizing compliance as a critical component of their operational frameworks.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into the Cloud Sandboxing Market is transforming how organizations approach cybersecurity. AI and ML technologies enhance the ability to detect and respond to threats in real-time, making cloud sandboxing more effective. By leveraging these technologies, organizations can automate the analysis of potential threats, improving response times and reducing the burden on security teams. The AI in cybersecurity market is projected to reach 46 billion dollars by 2027, indicating a strong trend towards incorporating advanced technologies into security solutions. This integration suggests that cloud sandboxing will evolve to become more sophisticated and responsive to emerging threats.