Rising Cybersecurity Threats

The Cloud Identity and Access Management Software Market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to adopt robust identity and access management solutions to safeguard sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime will cost businesses over 10 trillion dollars annually, underscoring the urgency for effective security measures. As a result, companies are investing in cloud IAM solutions to enhance their security posture, mitigate risks, and ensure compliance with industry standards. This trend indicates a strong correlation between the rise in cyber threats and the growth of the Cloud Identity and Access Management Software Market, as organizations prioritize the protection of their digital assets.

Shift to Remote Work Environments

The Cloud Identity and Access Management Software Market is witnessing a transformation driven by the shift to remote work environments. As organizations adapt to flexible work arrangements, the need for secure access to corporate resources from various locations has become paramount. In 2025, it is anticipated that over 30% of the workforce will be remote, necessitating the implementation of cloud IAM solutions to manage user identities and access rights effectively. This shift not only enhances productivity but also poses challenges in maintaining security and compliance. Therefore, organizations are increasingly investing in cloud IAM technologies to facilitate secure remote access, thereby propelling the growth of the Cloud Identity and Access Management Software Market. This trend underscores the evolving nature of work and its impact on identity and access management.

Regulatory Compliance Requirements

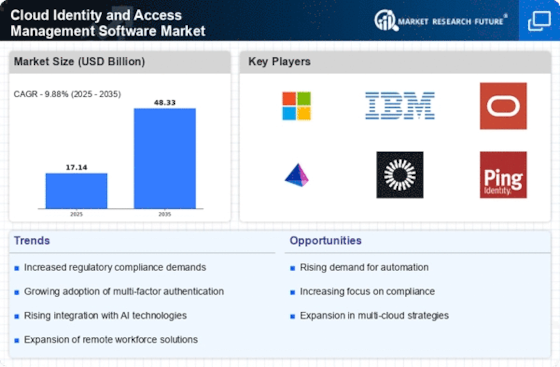

The Cloud Identity and Access Management Software Market is significantly influenced by the need for compliance with various regulatory frameworks. Regulations such as GDPR, HIPAA, and CCPA mandate stringent data protection measures, compelling organizations to implement comprehensive identity and access management solutions. In 2025, the market is projected to reach a valuation of approximately 20 billion dollars, driven by the necessity for compliance. Organizations are increasingly recognizing that failure to adhere to these regulations can result in severe penalties and reputational damage. Consequently, the demand for cloud IAM solutions is likely to surge as businesses strive to meet compliance requirements while ensuring secure access to sensitive information. This trend highlights the critical role of regulatory compliance in shaping the Cloud Identity and Access Management Software Market.

Increased Adoption of Cloud Services

The Cloud Identity and Access Management Software Market is experiencing robust growth due to the widespread adoption of cloud services across various sectors. As organizations migrate to cloud-based infrastructures, the need for effective identity and access management becomes increasingly critical. In 2025, it is projected that the cloud services market will exceed 500 billion dollars, driving demand for cloud IAM solutions that can seamlessly integrate with these services. Organizations are recognizing that traditional IAM solutions may not suffice in a cloud-centric environment, leading to a shift towards cloud-native IAM solutions. This trend highlights the necessity for organizations to adapt their identity and access management strategies to align with the evolving landscape of cloud services, thereby fueling the growth of the Cloud Identity and Access Management Software Market.

Integration with Advanced Technologies

The Cloud Identity and Access Management Software Market is being propelled by the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the capabilities of IAM solutions, enabling organizations to automate identity verification processes and detect anomalies in real-time. In 2025, the market is expected to witness a surge in demand for AI-driven IAM solutions, as organizations seek to improve efficiency and reduce operational costs. The incorporation of advanced analytics into cloud IAM systems allows for more informed decision-making regarding access controls and user management. This trend indicates a growing recognition of the importance of technological innovation in shaping the Cloud Identity and Access Management Software Market, as businesses strive to stay ahead in a competitive landscape.