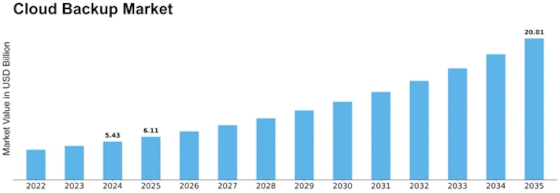

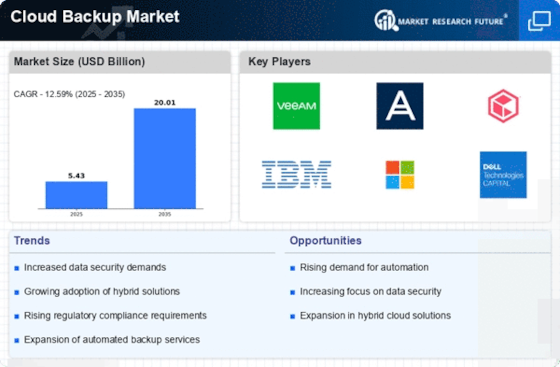

Cloud Backup Size

Cloud Backup Market Growth Projections and Opportunities

A number of market factors make the landscape for cloud backup a moving one. These influence both how fast different vendors can grow and, ultimately, what business you as an IT officer pick to go with in terms of services. The relentless expansion of data volumes generated by organizations is one pivotal factor. As business generate huge quantities of digital information, the need for safe and expandable data storage becomes increasingly urgent. One strategic response to this onslaught of data is cloud backup, an incredibly flexible and cost-effective alternative to traditional forms of on-premises storage. This quest for data creation is a fundamental driver in pushing the need for backup solutions into the cloud, ultimately caused by business efforts to digitalize and technology becoming ubiquitous.

Another critical market factor is the growing threat landscape in cyberspace. Proper cloud backup Awareness of the hazards and prevalence of cyberattacks, government pressure regarding adverse financial results after data loss, prompt organizations to invest in leading complete-service providers who not only store your data securely but also provide mechanisms for rapid recovery if you suffer a security incident. In making a decision on data storage and backup, businesses are heavily influenced by cost considerations. Hardware, maintenance and personnel costs traditionally account for a major portion of the capital expenditure associated with on-premises storage. With cloud backup services running on a subscription model, organizations can move from the capital expenditure to an operational framework. The flexible financial arrangements are attractive to businesses of all sizes, allowing them only to pay for what they use and their storage requirements as determined by changing needs. One reason for their wide adoption across the board is that cloud backup solutions are highly cost-effective. Another significant market factor is the regulatory environment and compliance requirements.

Leave a Comment