Market Analysis

In-depth Analysis of Cloud Backup Market Industry Landscape

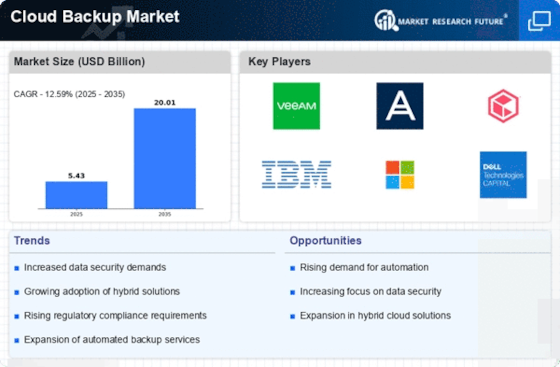

The global cloud backup market is set to reach US$ 5.6 BN by 2030, growing at a 21.10% CAGR between years 2022-2030. In recent years, the cloud backup market has been growing at a rapid pace. A number of factors have converged to highlight its importance amidst today's changing data management environment. All kinds of organizations in different industries are gradually beginning to understand the importance and urgency for reliable digital asset protection solutions that can scale. The growing volume of data generated by companies as a result is another major market dynamic driving this growth. Caused by the digital transformation juggernaut, this unprecedented explosion of data requires rapid and reliable systems for backing up information.

As the data deluge threatens to overwhelm enterprises, cloud backup's flexibility and scalability prove irresistible. In addition, another major factor shaping the competitive landscape of the cloud backup market is growing recognition that traditional methods for securing data are seriously flawed. Thus cyber threats are growing more serious, while the need to recover data quickly has become increasingly pressing. The drawbacks of conventional on-premises storage and tapebased backups have also come into ever clearer relief. Cloud backup not only provides off-site storage but also includes advanced security features, providing protection against hacking such as ransomware and data breaches. Such enterprises' heightened security consciousness is making cloud backup a necessary part of risk mitigation solutions.

Also, the arrival of hybrid and multi-cloud architectures has added a new layer to market complexities. More and more organizations are beginning to use the hybrid cloud model, combining private infrastructure with public or even private clouds. This change is due to wanting more flexibility, lower costs and better performance. As a result, the cloud backup market is increasingly seeing calls for solutions that can be easily integrated into hybrid and multi-cloud environments. In response, vendors in this space have been developing interoperable and agnostic backup solutions which fit the varying infrastructure demands of today's enterprises. Cost considerations also play a pivotal role in shaping the market dynamics of cloud backup. Traditional backup approaches often entail significant capital expenditures for hardware, maintenance, and personnel.

Leave a Comment