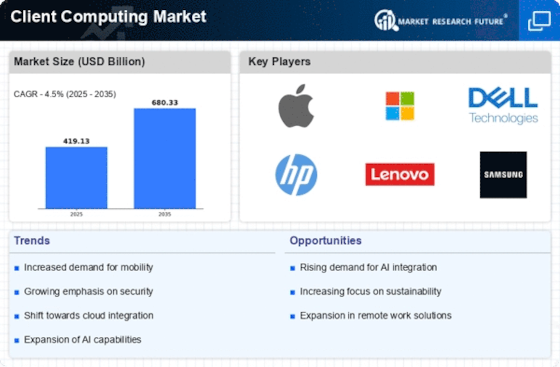

Leading market players are investing heavily in research and development to create innovative and technologically advanced products. This can involve the introduction of new features, improved performance, and enhanced security measures in devices like laptops, tablets, and desktop computers. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, diversification of product portfolio, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Client Computing Market industry must offer Innovative solution.

Companies are increasingly leveraging online sales channels. Establishing an effective direct-to-consumer model allows companies to reach customers more efficiently, gather valuable data, and provide personalized offerings in the Client Computing Market industry to benefit clients and increase the market share. In recent years, the Client Computing Market industry has offered some of the most significant advantages to Consumers. Major players in the Client Computing Market, including Apple, HP, Dell, Lenovo, Canon, and others, are attempting to increase market demand by investing in product development to increase their product line and cater to diverse consumer needs.

Apple Inc., headquartered in Cupertino, California, stands as the leader in technology, boasting the largest market capitalization and recording a revenue of US$394.3 billion in 2022.

As of June it ranks as the world's fourth-largest personal computer vendor by unit sales, the largest manufacturing company by revenue, and the second-largest mobile phone manufacturer. Renowned as one of the Big Five American information technology companies, Apple's influence extends across hardware, software, and services.

Famed for its innovation, iconic products like the iPhone, iPad, Mac, and services such as the App Store, Apple Music, and iCloud have positioned the company as a trailblazer in the tech industry, setting industry standards and shaping consumer experiences worldwide.

In May Apple unveiled a fresh, multiyear, multibillion-dollar partnership with Broadcom, a prominent U.S. technology and advanced manufacturing firm. In this joint effort, Broadcom will spearhead the development of 5G radio frequency components, notably FBAR filters, and state-of-the-art wireless connectivity components.

The construction of FBAR filters will be executed in various crucial American manufacturing and technology centers, with a focus on locations like Fort Collins, Colorado, housing a significant facility for Broadcom.

HP Development Company, L.P., a leading technology firm, operates on the principle that businesses should contribute positively to society. With a legacy spanning over 80 years, HP is committed to climate action, human rights, and digital equity, exemplifying a dedication to societal betterment. Their extensive product and service portfolio includes personal systems, printers, and 3D printing solutions, designed to foster innovation and make a meaningful impact. HP envisions a world where technological advancements drive extraordinary contributions to humanity, embracing inclusivity and recognizing that transformative ideas can emerge from anyone, anywhere.

This commitment positions HP as a forward-thinking company, leveraging technology to inspire progress and potentially change the world through thoughtful and inclusive innovation.

In March HP hosted the Amplify Partner Conference, HP Inc.’s, first in-person partner event in three years. Throughout this fully carbon-neutral event, the company revealed a range of bold new offerings aimed at driving long-term partner growth and lifetime customer value. The event, themed "Future Ready, Together We Win," invited partners to join HP in seizing opportunities across high-growth segments, including gaming, hybrid work, workforce services, security, and sustainability.