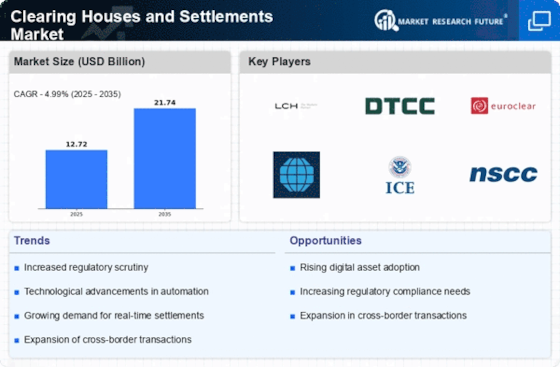

Market Volatility

Market volatility serves as a critical driver for the Clearing Houses and Settlements Market. Fluctuations in asset prices often lead to increased trading activity, necessitating efficient clearing and settlement processes. During periods of heightened volatility, the demand for clearing services tends to surge, as market participants seek to mitigate counterparty risk. Data suggests that during significant market events, the volume of transactions processed by clearing houses can increase by over 30%. This trend underscores the importance of having robust clearing mechanisms in place to handle sudden spikes in trading activity. As financial markets continue to exhibit volatility, the Clearing Houses and Settlements Market is likely to expand, driven by the need for reliable and efficient clearing solutions.

Regulatory Compliance

Regulatory compliance remains a pivotal driver within the Clearing Houses and Settlements Market. As financial markets evolve, regulatory bodies are implementing stringent measures to ensure transparency and mitigate systemic risks. The introduction of regulations such as the Dodd-Frank Act and EMIR has necessitated the establishment of more robust clearing mechanisms. These regulations mandate that a significant portion of derivatives transactions be cleared through central counterparties, thereby increasing the volume of transactions processed by clearing houses. Recent statistics indicate that compliance costs for financial institutions have risen, leading to a greater reliance on clearing houses to manage these complexities. Consequently, the Clearing Houses and Settlements Market is positioned to grow as firms prioritize compliance and seek efficient solutions to navigate the regulatory landscape.

Technological Advancements

The Clearing Houses and Settlements Market is experiencing a notable transformation driven by rapid technological advancements. Innovations such as blockchain technology and artificial intelligence are reshaping traditional processes, enhancing efficiency and security. For instance, the integration of distributed ledger technology is expected to streamline settlement processes, reducing the time and cost associated with transactions. According to recent data, the adoption of these technologies could potentially decrease settlement times by up to 50%. Furthermore, the increasing reliance on digital platforms for trading necessitates robust clearing mechanisms, thereby propelling the demand for advanced clearing houses. As firms seek to optimize their operations, the Clearing Houses and Settlements Market is likely to witness a surge in investments aimed at technological upgrades.

Emerging Market Participation

The participation of emerging markets in the Clearing Houses and Settlements Market is becoming increasingly prominent. As these markets develop, there is a growing need for efficient clearing and settlement infrastructure to support their financial systems. Emerging economies are witnessing a surge in trading activities, which necessitates the establishment of local clearing houses to manage these transactions effectively. Recent reports indicate that the volume of trades in emerging markets has increased by over 15% annually, highlighting the potential for growth in this sector. Additionally, as international investors seek opportunities in these markets, the demand for reliable clearing services is likely to rise. Consequently, the Clearing Houses and Settlements Market is expected to expand as it adapts to the needs of emerging market participants.

Increased Cross-Border Transactions

The rise in cross-border transactions is significantly influencing the Clearing Houses and Settlements Market. As businesses expand their operations internationally, the complexity of clearing and settlement processes increases. This trend necessitates the establishment of clearing houses that can effectively manage multi-currency transactions and diverse regulatory environments. Recent data indicates that cross-border trade has grown by approximately 20% over the past few years, further emphasizing the need for efficient clearing solutions. Clearing houses are adapting by enhancing their capabilities to facilitate these transactions, thereby ensuring compliance with various jurisdictions. As the volume of cross-border transactions continues to rise, the Clearing Houses and Settlements Market is poised for growth, driven by the demand for specialized clearing services.