Growth of E-commerce and Online Retail

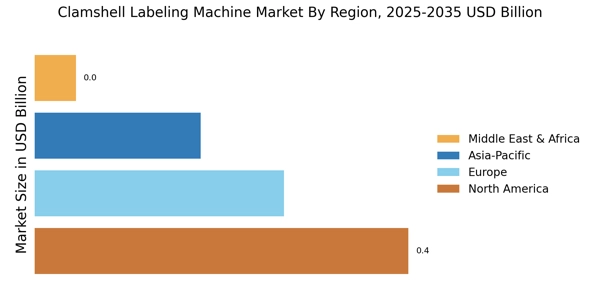

The growth of e-commerce and online retail is significantly influencing the Clamshell Labeling Machine Market. As more consumers turn to online shopping, the demand for efficient and visually appealing packaging has escalated. Clamshell packaging, known for its durability and transparency, is particularly favored for shipping products safely while showcasing them effectively. Data indicates that e-commerce sales are projected to reach over 6 trillion dollars by 2024, which underscores the necessity for packaging solutions that can meet the demands of this expanding market. Consequently, manufacturers are increasingly investing in clamshell labeling machines to enhance their packaging processes, ensuring that products arrive in optimal condition. This trend is likely to continue, further propelling the growth of the Clamshell Labeling Machine Market.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent, thereby impacting the Clamshell Labeling Machine Market. Manufacturers are required to adhere to various regulations concerning labeling accuracy, safety, and environmental impact. This has led to a heightened focus on investing in labeling machines that not only meet these standards but also enhance product traceability. Data from industry reports indicates that compliance-related investments in packaging machinery are expected to rise by approximately 20% over the next few years. As companies strive to maintain compliance while ensuring consumer safety, the demand for advanced clamshell labeling machines that can accommodate these requirements is likely to grow. This trend underscores the importance of regulatory considerations in shaping the Clamshell Labeling Machine Market.

Consumer Preference for Sustainable Packaging

Consumer preference for sustainable packaging is a driving force in the Clamshell Labeling Machine Market. As environmental concerns become more pronounced, consumers are increasingly favoring products that utilize eco-friendly packaging solutions. Clamshell packaging, which can be made from recyclable materials, aligns well with this trend. Recent studies indicate that nearly 70% of consumers are willing to pay more for products packaged sustainably, which is prompting manufacturers to adopt clamshell labeling machines that facilitate the use of such materials. This shift not only meets consumer demand but also helps companies enhance their brand image and market competitiveness. As sustainability continues to gain traction, the Clamshell Labeling Machine Market is likely to evolve in response to these changing consumer preferences.

Rising Demand for Efficient Packaging Solutions

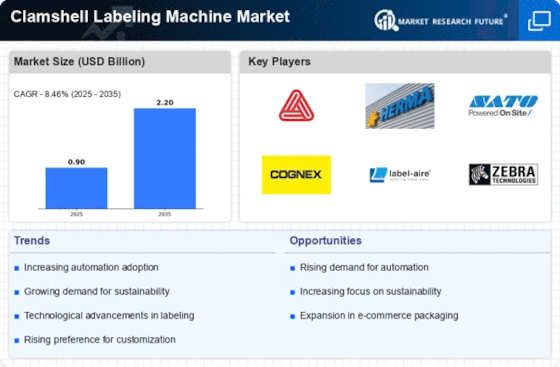

The Clamshell Labeling Machine Market is experiencing a notable surge in demand for efficient packaging solutions. As consumer preferences shift towards convenience and sustainability, manufacturers are increasingly adopting clamshell packaging due to its protective qualities and aesthetic appeal. This trend is further supported by data indicating that the packaging machinery market is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. The clamshell labeling machines, which enhance the visual presentation of products, are becoming essential in sectors such as food, pharmaceuticals, and consumer goods. Consequently, the need for advanced labeling technologies that ensure accuracy and speed is paramount, driving innovation and investment in the Clamshell Labeling Machine Market.

Technological Advancements in Labeling Machinery

Technological advancements play a pivotal role in shaping the Clamshell Labeling Machine Market. Innovations such as smart labeling systems, which integrate artificial intelligence and machine learning, are enhancing operational efficiency and accuracy. These advancements allow for real-time monitoring and adjustments, reducing waste and improving production timelines. Recent data suggests that the adoption of automated labeling solutions is expected to increase by over 30% in the coming years, as companies seek to streamline their operations. Furthermore, the integration of IoT technology in labeling machines is facilitating better data collection and analysis, which can lead to improved decision-making processes. As a result, the Clamshell Labeling Machine Market is likely to witness a significant transformation driven by these technological enhancements.