Advancements in Precision Medicine

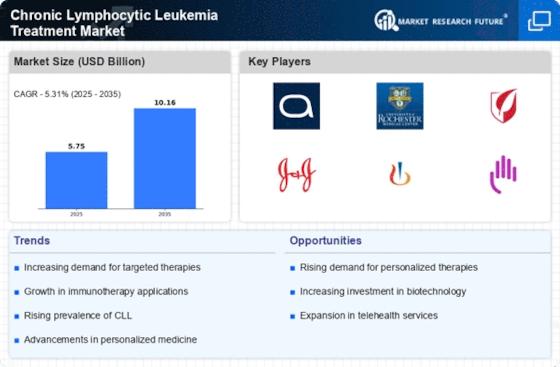

Advancements in precision medicine are transforming the Chronic Lymphocytic Leukemia Treatment Market. The integration of genetic profiling and biomarker identification allows for tailored treatment approaches, enhancing therapeutic efficacy. For instance, targeted therapies such as ibrutinib and venetoclax have shown promising results in specific patient populations, leading to improved outcomes. The market for precision medicine in CLL is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. This shift towards personalized treatment regimens not only improves patient outcomes but also drives the demand for innovative therapies, thereby shaping the future landscape of the Chronic Lymphocytic Leukemia Treatment Market.

Rising Investment in Oncology Research

The rising investment in oncology research is a crucial driver for the Chronic Lymphocytic Leukemia Treatment Market. Pharmaceutical companies and research institutions are increasingly allocating resources to develop novel therapies for CLL. In recent years, funding for cancer research has surged, with billions of dollars being invested annually. This influx of capital facilitates the exploration of new treatment modalities, including immunotherapies and combination therapies. As a result, the Chronic Lymphocytic Leukemia Treatment Market is likely to witness a surge in innovative products entering the market, enhancing treatment options for patients and potentially improving survival rates.

Growing Awareness and Education Initiatives

Growing awareness and education initiatives regarding Chronic Lymphocytic Leukemia are significantly influencing the Chronic Lymphocytic Leukemia Treatment Market. Increased efforts by healthcare organizations and patient advocacy groups to educate the public about CLL symptoms, risk factors, and treatment options are fostering early diagnosis and intervention. This heightened awareness is likely to lead to an increase in patient consultations and treatment initiation, thereby driving market growth. Furthermore, educational campaigns aimed at healthcare professionals are enhancing their understanding of CLL management, which may result in more effective treatment strategies being employed in clinical practice. Consequently, the Chronic Lymphocytic Leukemia Treatment Market is poised for expansion as more patients seek appropriate therapies.

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is emerging as a significant driver in the Chronic Lymphocytic Leukemia Treatment Market. Regulatory agencies are increasingly expediting the approval processes for new treatments, particularly those that demonstrate substantial clinical benefits. This trend is evident in the approval of several novel agents for CLL in recent years, which has expanded the treatment landscape. The favorable regulatory environment encourages pharmaceutical companies to invest in research and development, knowing that their innovative therapies may receive timely approval. As a result, the Chronic Lymphocytic Leukemia Treatment Market is likely to experience a wave of new product launches, enhancing treatment options for patients and potentially improving clinical outcomes.

Increasing Incidence of Chronic Lymphocytic Leukemia

The rising incidence of Chronic Lymphocytic Leukemia (CLL) is a pivotal driver for the Chronic Lymphocytic Leukemia Treatment Market. Recent statistics indicate that CLL accounts for approximately 30% of all leukemias diagnosed in adults. This increasing prevalence necessitates the development and availability of effective treatment options. As the population ages, the number of CLL cases is expected to rise, thereby amplifying the demand for innovative therapies. The growing awareness among healthcare professionals and patients regarding CLL symptoms and treatment options further contributes to this trend. Consequently, pharmaceutical companies are likely to invest more in research and development to address this unmet medical need, thereby propelling the Chronic Lymphocytic Leukemia Treatment Market forward.