Market Analysis

In-depth Analysis of Chromatography Reagents Market Industry Landscape

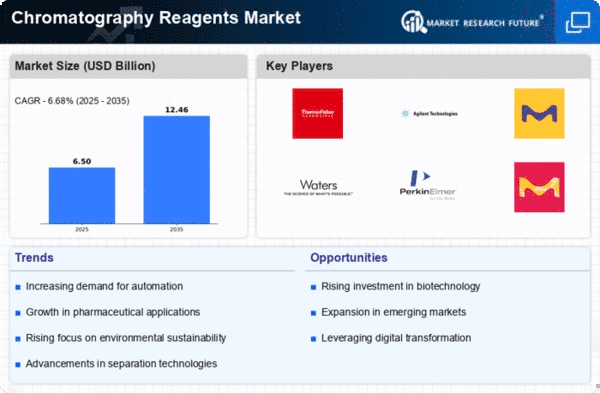

The Chromatography Reagents market plays a pivotal role in the field of analytical chemistry, providing essential tools for separating and analyzing complex mixtures. These reagents are crucial components in various chromatographic techniques, such as gas chromatography (GC), liquid chromatography (LC), and thin-layer chromatography (TLC). High analytical methods in the pharmaceuticals, biotechnology, environmental monitoring, and food and beverage industries are on the rise and lead to more and more chromatography reagents. These reagents permit consistent as well as accurate separation and identification of chemicals included in a mixture as a tool in quality control and research. HPLC is a strong technique and gains dominance in the chromatography market. Advancements in HPLCs demand for the reagents increases significantly because of its advantages over other methods separation and analysis for a wide variety of compounds. Particularly, pharmaceutical and biotechnology industries prefer HPLC for its application in the development of drugs as well as in quality control. There are many devices and instruments that are used under the chromatography system within so many sectors; one of the major sectors is known as the pharmaceutical sector that is known as a major contributor of the chromatography reagents market. As drug development requires stringent regulations and tons of analytical data that needed to be exact, the role of chromatography techniques and reagents is vital thus become indispensable tools. Market growth is substantially increasing along with the growing research and development activities in the pharmaceutical sector. Increasing advances in chromatography in the form of new columns, stationary phases and detectors also drive the market. There are other innovations which improve the sensitivity of chromatographic methods. This utilization of such advantages has also raised the demand of such write and read reagents that largely support those advances. Asia is experiencing rapid expansion of the market of chromatography reagents. Growing investment in the regional health infrastructure, rising R&D activities and growing pharmaceutical and biotechnology sectors in nations such as China and India lead to the markets dynamics in the region. Chromatography reagents market is also finding its use in non – conventional industries along with a marked growth in environmental testing. Governments and regulatory bodies promote the environmental monitoring, therefore the use the chromatography techniques to analyze pollutants and check out the compliance with the environmental standards is increasing. The market is dominated by leading manufacturers providing a wide scope of chromatography reagents. More novel reagents with better performance are put to the market by companies that are actively engaged in research and development. Stevens Virgin More Over, the Market Players Use Partnerships, Mergers, And Acquisitions as Strategies to Strengthen Their Positions And Widen Their Product Portfolios. Chromatography reagents market has growth challenge due to high cost of advanced the chromatography instruments and reagents. By this contradicts comes the task to deal with this challenge that, but give an opportunity to manufactures to dedicate on creating more cost-effective solutions without compromise on quality and broadening the market. The chromatography reagents market is poised for continued growth, driven by technological advancements, increasing research activities, and expanding applications across diverse industries. As the demand for more accurate and sophisticated analytical techniques rises, the market is likely to witness a surge in innovations and collaborations, shaping the future of chromatography.

Leave a Comment