Market Trends

Key Emerging Trends in the Chinese Fibromyalgia Market

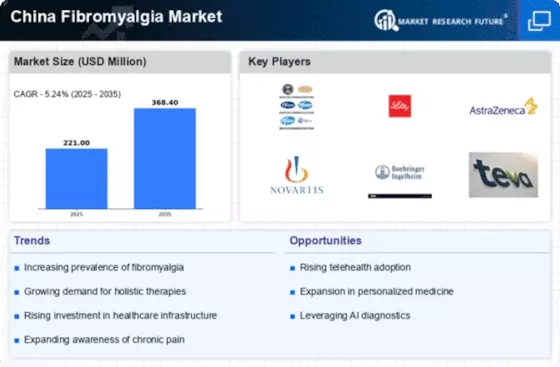

The Chinese fibromyalgia market is witnessing a surge in awareness about the condition among healthcare professionals and the general population. Increased recognition of fibromyalgia symptoms and diagnostic criteria has led to more accurate diagnoses. There's a noticeable uptick in the incidence of fibromyalgia cases across China. Factors such as changing lifestyles, urbanization, and improved healthcare access contribute to the growing number of reported cases. Now a thriving landscape of fibromyalgia management therapies can be seen at the haymarket. In the case of Traditional Chinese Medicine (TCM), there are healing methods that are broadly subscribed with regular Western treatment, e.g. acupuncture, medicinal herbs. Along with this, pharmaceutical institutions clinching their pockets into research and development programs providing new medications solely for treating fibromyalgia symptoms appear in a wave. These medications will be used to deal with pain, make fatigue better and help with having good sleep. Due to the digital health technology dominating the areas related with fibromyalgia management, integration is growing. Mobile apps, wearable gadgets, and telemedicine platforms ensure that patients can track their condition remotely, learn more using on-line resources in a convenient format, communicate with healthcare specialists in the absence of physical meetings with them. Actually, there has emerged thefully-functioning system of patient advocacy groups and support networks tasked to give people more insight into fibromyalgia in China. These groups have been executing a significant role in providing tools, instruction and emotional assistance to the people with the illness. The fiber malehahiotic landscape in China is continuing changing, the ongoing study be will focused on the underlying mechanisms of the condition. Fruitful joint efforts of academia, hospitals, and businesses are behind advanced research, new treatment methods, and clinical practices. It is a rather positive trend which is observable due to Chinese came up with a number of measures to modernize the medical infrastructure of the country on the fibromyalgia market. Such investments in healthcare facilities, competent personnel and specialized clinics bring about greater accessibility to both medical diagnosis and treatment for patients. The public health strategies that contribute positively to early detection and management of fibromyalgia have started gaining front row seats. Available programs developed and co-financed by government to increase public knowledge about the shortlist of early symptoms, signs and credible resources for both patients and caregivers. Medical progress notwithstanding, equality of fibromyalgia treatment and support services is oftentimes hard to come by, even within a streamlined and uniform healthcare structure in the country. In the time set as deadline is still hard to achieve full healthcare equality between the urban and rural areas, also middle class still cannot afford some treatments expenses.

There's a growing recognition of the importance of holistic approaches in fibromyalgia management. Integrative therapies combining conventional medicine with lifestyle modifications, stress management techniques, and mind-body interventions are increasingly favored by patients and healthcare providers alike. Intensifying competition among pharmaceutical companies and healthcare providers in the fibromyalgia market is driving innovation and pushing for the development of more effective treatment options and patient-centric care models.

Leave a Comment