Market Analysis

In-depth Analysis of Chinese Fibromyalgia Market Industry Landscape

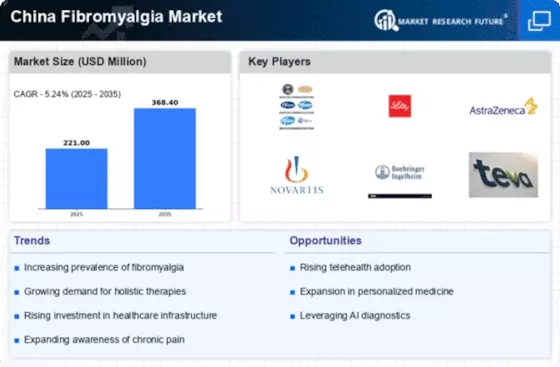

The Chinese fibromyalgia market is witnessing a surge in prevalence, with a significant portion of the population affected by this chronic pain condition. This rising prevalence is attributed to factors like changing lifestyles, increased awareness, and improved diagnostic techniques. With the increasing number of fibromyalgia cases, there's a heightened demand for effective treatments in the Chinese market. Patients are seeking relief from symptoms such as widespread pain, fatigue, and sleep disturbances, driving the need for innovative therapeutic solutions. In China, the treatment pattern for fibromyalgia is continuously evolving, fibromyalgia is treated holistically with both traditional treatments and alternative therapies. The traditional remedies include pain relievers, anti-depressants, and anti-seizure medications, but alternative avenues such as acupuncture, herbal remedies, and mind-body interventions are now being explored. Even though the interest in fibromyalgia among Chinese consumers is on the rise, the industry also faces a number of challenges. The low levels of awareness that both health professionals and the public have often results in underestimation and a lack of proper direction of the condition which in most cases leads to uncontrolled progress of the disorder. However, in narrow areas, it is a question of at-home specialty care as well as high-quality treatment options availability. Chinese patients with fibromyalgia are being offered novel treatments that either need regulation or are proved safe, in an evolving regulatory environment. Public health regulators are making efforts in optimizing approval processes for new drugs while keeping strict standards of effectiveness and safety simultaneously. From the drug import and approval to distribution, foreign firms that would like to enter the Chinese market of fibromyalgia confront many barriers to entry. In addition to the above, launching and promoting a medical device requires developing strategies for dealing with intricate regulatory as well as business processes, acquiring cooperation by local distributors and producers, and comprehending the specific market dynamics and demands of patients. As whole, the Chinese real fibromyalgia medicine is experiencing active research and development initiatives targeting to produce new treatment options. For this reason, investigation of TCM prescriptions (TCM), herbs and composite therapy, is important in management of fibromyalgia symptoms. And there is notably a high tendency among medical marketing channels in the Chinese fibromyalgia market to emphasis on patients’ education and support initiatives. Among the key players are the healthcare professionals, advocacy groups, and also the pharmaceutical companies, who are continuously striving to create an awareness, run educational programs, and offer support programs for the patients and their families as well.

Despite challenges, the Chinese fibromyalgia market presents significant expansion opportunities for pharmaceutical companies and healthcare providers. With the increasing recognition of fibromyalgia as a legitimate medical condition and the growing acceptance of diverse treatment approaches, the market is ripe for innovation and growth. Looking ahead, the Chinese fibromyalgia market is poised for continued growth and evolution. Factors such as advancements in diagnostic technologies, expanding treatment options, increasing healthcare infrastructure, and growing patient advocacy are expected to shape the future landscape of fibromyalgia management in China. As awareness continues to improve and research efforts intensify, the market is likely to witness a shift towards more personalized and comprehensive care approaches tailored to the unique needs of fibromyalgia patients in China.

Leave a Comment