Top Industry Leaders in the China XR Hardware Market

The Competitive Landscape of the China XR Hardware Market

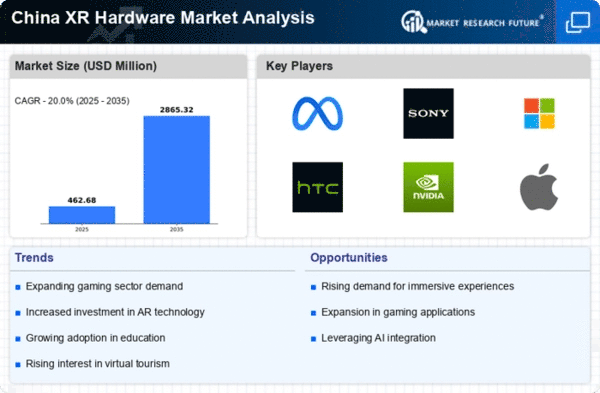

China's XR hardware market, has ignited the imaginations of both global tech giants and homegrown innovators. From immersive virtual reality (VR) headsets to augmented reality (AR) glasses shaping the future of retail and manufacturing, this dynamic landscape presents both incredible opportunities and fierce competition. Understanding the intricacies of this market is crucial for anyone seeking to carve their niche in this digital frontier.

Key Players:

- Accenture plc

- Qualcomm Incorporated

- Unity Technologies

- Adobe Inc.

- Alphabet Inc.

- SoftServe Inc.

- Northern Digital Inc.

- Sony Corporation

- Facebook Inc.

- Microsoft Corporation

- Tata Elxsi

- Semcon

- HTC Corporation

Strategies Adopted by Leaders

- Technological Prowess: Leading players like Pico Interactive and ByteDance (through Pico) invest heavily in R&D, pushing boundaries in display technology, haptics, and controller design. They pioneer solutions like high-resolution OLED displays, advanced hand-tracking systems, and wireless headsets, offering unrivaled immersive experiences and catering to diverse user preferences.

- Cost-Effectiveness and Value Localization: Chinese companies excel at offering high-quality XR hardware at competitive prices, often adapting technologies for local preferences and needs. This resonates with budget-conscious consumers and makes XR technology more accessible within the vast Chinese market.

- Content Ecosystem Development: Recognizing the importance of compelling content, players like iQIYI and Nreal invest in creating localized VR games, educational experiences, and AR applications tailored to Chinese audiences. This fosters a thriving ecosystem and enhances user engagement.

- Strategic Partnerships and Collaborations: Collaborations with technology providers, game developers, and content creators accelerate innovation and broaden market reach. For instance, partnerships with chipmakers enable access to cutting-edge processors for XR devices, while collaborations with universities drive research and development.

- Government Initiatives and Support: The Chinese government actively supports the development of the XR industry through policy initiatives, funding programs, and talent development initiatives. This creates a favorable environment for domestic players and attracts foreign investment.

Factors for Market Share Analysis:

- Device Type: Analyzing market share by device type (VR headsets, AR glasses, mixed reality headsets) reveals dominant players in each segment and future growth potential. VR headsets currently hold the largest share, but AR glasses are expected to see the fastest growth due to their versatility and practical applications.

- Target Audience: Understanding the needs of different user segments (gamers, professionals, consumers) is key. Pico excels in VR headsets for gaming enthusiasts, while Nreal focuses on AR glasses for business and educational applications.

- Distribution Channels: Online and offline retail channels play a crucial role. Companies like Xiaomi leverage their existing smartphone distribution networks to reach a wider audience, while VR arcades offer immersive experiences and attract early adopters.

- Price Point and Features: The Chinese market is highly price-sensitive, but consumers also value advanced features. Finding the right balance between affordability and innovation is crucial for success.

New and Emerging Companies:

- Rokid Corporation: This company specializes in AR glasses for industrial applications, offering solutions for remote assistance, training, and maintenance tasks, catering to the growing demand for XR in smart manufacturing.

- Goertek: This leading electronics manufacturer leverages its expertise to develop VR and AR hardware for established brands, aiming to become a major player in the XR hardware supply chain.

- Xpeng: This electric vehicle manufacturer expands its technology portfolio by entering the XR market, developing lightweight and comfortable VR headsets targeted at entertainment and gaming enthusiasts.

Industry Developments:

Pico Interactive

- Dec 2023: Partnered with Qualcomm to develop next-generation VR headsets powered by Snapdragon XR2 Gen 2 platform, offering enhanced processing and graphics capabilities.

ByteDance

- Nov 2023: Launched Pico 4 Pro, a high-end VR headset targeting gaming enthusiasts, featuring advanced hand-tracking, improved visuals, and wireless connectivity.

iQIYI

- Oct 2023: Announced plans to invest USD 1 billion in VR content development over the next three years, focusing on immersive games, educational experiences, and virtual tourism.