Rising Energy Demand

China's rapid urbanization and industrialization have led to a significant increase in energy demand, which is projected to grow by around 3.5% annually over the next decade. This rising demand necessitates the modernization of the existing energy infrastructure, thereby propelling the smart grid market. The current grid system struggles to meet peak demand, resulting in energy shortages and inefficiencies. Smart grid technologies, which enhance grid reliability and efficiency, are essential for managing this growing demand. By integrating advanced technologies, the smart grid market can facilitate better load management and energy distribution, ultimately ensuring a stable energy supply for consumers and industries alike.

Government Policy Support

The Chinese government actively promotes the smart grid market through various policies and initiatives aimed at enhancing energy efficiency and sustainability. This support includes substantial funding and incentives for smart grid projects, which are expected to reach approximately $100 billion by 2030. The government's commitment to reducing carbon emissions and increasing the share of renewable energy sources in the energy mix further drives the smart grid market. Policies such as the 13th Five-Year Plan emphasize the importance of smart grid technology in achieving energy security and environmental goals. As a result, the smart grid market is likely to experience accelerated growth due to favorable regulatory frameworks and financial backing.

Technological Advancements

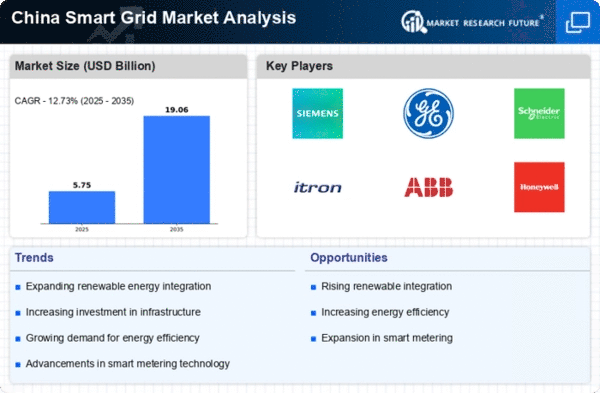

The smart grid market in China is significantly influenced by rapid technological advancements in communication, automation, and data analytics. Innovations such as Internet of Things (IoT) devices and artificial intelligence (AI) are transforming traditional energy systems into intelligent networks. These technologies enable real-time monitoring and control of energy consumption, enhancing operational efficiency. The market for smart grid technologies is expected to grow at a CAGR of approximately 20% from 2025 to 2030. As these technologies become more affordable and accessible, their adoption is likely to increase, further driving the smart grid market and improving the overall energy management landscape.

Integration of Electric Vehicles

The growing adoption of electric vehicles (EVs) in China is poised to have a profound impact on the smart grid market. With the government aiming for 20% of all vehicles to be electric by 2025, the demand for charging infrastructure and smart grid solutions is expected to surge. This integration requires advanced grid management systems to handle the increased load and ensure efficient energy distribution. The smart grid market is likely to benefit from the development of vehicle-to-grid (V2G) technologies, which allow EVs to return energy to the grid during peak demand periods. This symbiotic relationship between EVs and smart grid technologies could enhance grid stability and promote renewable energy usage.

Focus on Renewable Energy Integration

China's commitment to increasing the share of renewable energy in its energy mix is a critical driver for the smart grid market. The government has set ambitious targets, aiming for renewable sources to account for 50% of total energy consumption by 2030. This transition necessitates the development of smart grid technologies that can effectively integrate variable renewable energy sources such as solar and wind. The smart grid market is expected to play a pivotal role in managing the intermittency of these energy sources, ensuring a reliable and stable energy supply. As investments in renewable energy infrastructure continue to grow, the smart grid market is likely to expand in tandem, facilitating a more sustainable energy future.