Aging Population

China's aging population is a significant factor influencing the single photon-emission-computed-tomography market. With an increasing number of elderly individuals, the prevalence of chronic diseases such as cardiovascular disorders and cancer is also on the rise. According to recent statistics, by 2025, it is projected that over 300 million people in China will be aged 60 and above. This demographic shift necessitates advanced diagnostic imaging technologies to facilitate early detection and treatment of diseases. Consequently, healthcare providers are likely to invest more in single photon-emission-computed-tomography systems to cater to the diagnostic needs of this growing population segment, thereby driving market expansion.

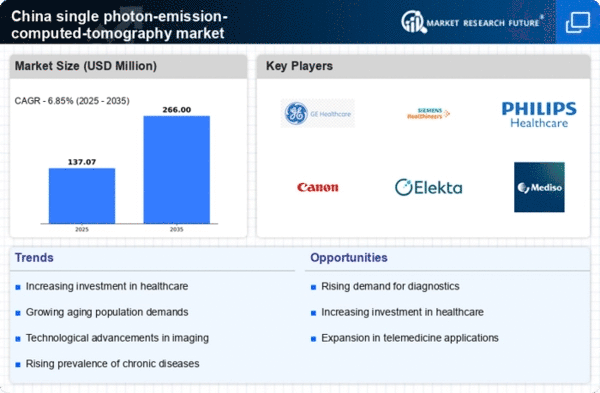

Increasing Healthcare Expenditure

The rising healthcare expenditure in China is a pivotal driver for the single photon-emission-computed-tomography market. As the government allocates more funds towards healthcare, the demand for advanced diagnostic tools, including single photon-emission-computed-tomography systems, is likely to increase. In 2023, healthcare spending in China reached approximately $1.2 trillion, reflecting a growth rate of around 10% annually. This trend suggests that hospitals and diagnostic centers are more inclined to invest in cutting-edge technologies to enhance patient care. Furthermore, the emphasis on improving healthcare infrastructure and expanding access to medical services may lead to a higher adoption rate of single photon-emission-computed-tomography systems, thereby propelling market growth in the coming years.

Rising Awareness of Diagnostic Imaging

There is a growing awareness among healthcare professionals and patients regarding the benefits of diagnostic imaging, which serves as a catalyst for the single photon-emission-computed-tomography market. Educational campaigns and training programs are being conducted to inform stakeholders about the advantages of early diagnosis and the role of advanced imaging techniques. This heightened awareness is likely to drive demand for single photon-emission-computed-tomography systems, as healthcare providers seek to offer comprehensive diagnostic services. Furthermore, as patients become more informed about their health options, they may advocate for advanced imaging solutions, further propelling market growth.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the landscape of medical diagnostics in China, thereby impacting the single photon-emission-computed-tomography market. Innovations such as artificial intelligence and machine learning are being incorporated into imaging systems to enhance diagnostic accuracy and efficiency. Hospitals are increasingly adopting these technologies to streamline operations and improve patient outcomes. For instance, the use of AI algorithms in analyzing single photon-emission-computed-tomography images can significantly reduce interpretation time and increase diagnostic confidence. This trend indicates a potential for market growth as healthcare facilities seek to leverage technology to provide superior diagnostic services.

Government Initiatives for Healthcare Improvement

The Chinese government has implemented various initiatives aimed at improving healthcare services, which positively affects the single photon-emission-computed-tomography market. Policies promoting the adoption of advanced medical technologies are being prioritized to enhance diagnostic capabilities across the nation. For example, the Healthy China 2030 initiative emphasizes the importance of early disease detection and prevention, which aligns with the capabilities of single photon-emission-computed-tomography systems. As a result, hospitals and clinics are likely to receive support for acquiring these technologies, leading to increased market penetration and growth opportunities in the sector.