Advancements in Biotechnology

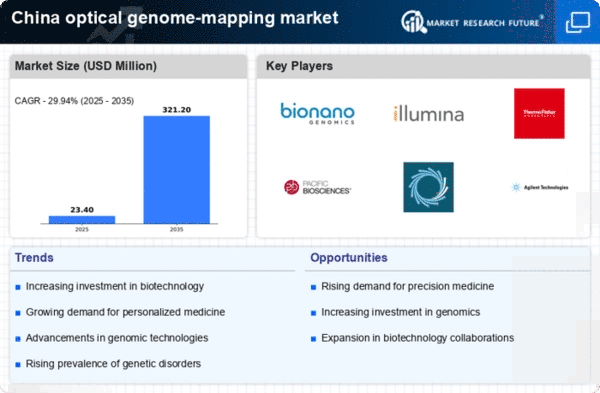

The optical genome-mapping market is being propelled by significant advancements in biotechnology within China. Innovations in sequencing technologies and data analysis are enhancing the capabilities of optical genome mapping, making it more accessible and efficient. The market is projected to grow at a CAGR of around 15% over the next five years, driven by these technological improvements. As biotechnological firms continue to develop novel applications for optical genome mapping, the industry is likely to see an influx of new products and services, further solidifying its position in the broader genomic landscape.

Increasing Research Initiatives

The optical genome-mapping market in China is experiencing a surge in research initiatives aimed at understanding genetic disorders and enhancing agricultural productivity. Government and private institutions are investing heavily in genomic research, which is projected to reach a market value of approximately $1.5 billion by 2026. This influx of funding is likely to drive the demand for advanced optical genome-mapping technologies, as researchers seek to utilize these tools for high-resolution genome analysis. The focus on personalized medicine and crop improvement is expected to further stimulate the optical genome-mapping market, as stakeholders recognize the potential of these technologies in addressing complex biological questions.

Growing Awareness of Genetic Disorders

There is a notable increase in awareness regarding genetic disorders among the Chinese population, which is influencing the optical genome-mapping market. As more individuals seek genetic testing for hereditary conditions, the demand for precise and efficient mapping technologies is likely to rise. This trend is supported by the fact that approximately 10% of the population is affected by genetic disorders, creating a substantial market for diagnostic solutions. The optical genome-mapping market is positioned to benefit from this growing awareness, as healthcare providers and patients alike recognize the importance of accurate genomic information in treatment planning and disease prevention.

Collaboration Between Academia and Industry

The optical genome-mapping market is benefiting from increased collaboration between academic institutions and industry players in China. These partnerships are fostering innovation and accelerating the development of new applications for optical genome mapping. By combining academic research with commercial expertise, stakeholders are likely to create more effective solutions for genomic analysis. This collaborative environment is expected to enhance the market's growth, as it encourages the sharing of knowledge and resources, ultimately leading to advancements in optical genome-mapping technologies that meet the evolving needs of researchers and healthcare providers.

Increased Investment in Healthcare Infrastructure

China's ongoing investment in healthcare infrastructure is a critical driver for the optical genome-mapping market. The government has allocated substantial resources to improve healthcare facilities and expand access to advanced diagnostic tools. This investment is expected to enhance the availability of optical genome-mapping technologies in hospitals and research institutions, facilitating their adoption in clinical settings. With an estimated growth in healthcare spending to reach $1 trillion by 2025, the optical genome-mapping market stands to gain from improved infrastructure and increased accessibility to cutting-edge genomic technologies.