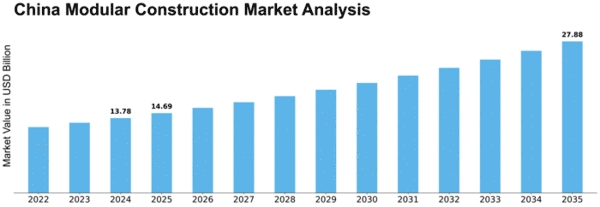

China Modular Construction Size

China Modular Construction Market Growth Projections and Opportunities

The China Modular Construction Market is influenced by a multitude of factors that collectively shape its dynamics and growth. One of the primary drivers propelling this market is the rapid urbanization and the need for efficient and cost-effective construction solutions. With China experiencing significant population migration to urban areas, there is a growing demand for fast and scalable construction methods. Modular construction, with its off-site fabrication and assembly, meets this demand by offering speed, precision, and reduced construction timelines, making it a preferred choice for various building types, including residential, commercial, and institutional structures.

Changing government policies and initiatives play a pivotal role in shaping the China Modular Construction Market. The Chinese government has been actively promoting the use of prefabricated and modular construction methods to address challenges such as housing shortages, urban congestion, and the need for sustainable development. Policies that incentivize the adoption of modular construction techniques, coupled with supportive regulations and standards, have created a conducive environment for the growth of the modular construction market in China.

Technological advancements and innovations contribute significantly to the market dynamics of modular construction in China. Continuous research and development efforts in materials, design, and construction processes lead to improvements in the quality, durability, and customization options of modular buildings. The integration of digital technologies, Building Information Modeling (BIM), and automation further enhances the efficiency and precision of modular construction, facilitating the development of high-quality and sophisticated modular structures.

Market factors are also influenced by the sustainability and environmental considerations driving the construction industry in China. Modular construction, characterized by reduced waste generation, minimized site disturbances, and energy-efficient practices, aligns with the country's broader goals of green and sustainable development. The ability of modular construction to optimize resource use, coupled with the government's focus on eco-friendly construction practices, contributes to the increasing adoption of modular methods in the Chinese construction sector.

Economic conditions and the demand for cost-effective construction solutions impact the China Modular Construction Market. The cost-effectiveness of modular construction stems from its ability to streamline processes, reduce labor costs, and minimize construction delays. As economic factors drive the demand for efficient and budget-friendly construction methods, modular construction emerges as a strategic solution for developers, contractors, and investors looking to optimize project costs while maintaining construction quality.

Consumer preferences and the growing acceptance of modular construction contribute to market growth. With increasing awareness of the benefits of modular buildings, consumers are more open to considering modular solutions for their construction projects. The ability to customize modular designs, coupled with the assurance of high-quality construction, resonates with consumers seeking efficient and modern building solutions in China's evolving real estate landscape.

The competitive landscape and industry collaborations influence market factors in China's Modular Construction Market. Manufacturers, developers, and construction companies are actively engaging in collaborations and partnerships to leverage each other's strengths and capitalize on the growing demand for modular construction. The competitive nature of the market is driving innovation, driving the development of new technologies, and expanding the range of modular construction applications.

Urbanization trends and the need for rapid infrastructure development further contribute to the demand for modular construction in China. As cities expand and infrastructure requirements increase, modular construction provides a scalable and efficient solution for meeting the demands of urbanization. The ability to construct modular buildings quickly and in a controlled environment addresses the urgency of developing infrastructure in rapidly growing urban areas.

Leave a Comment