Emergence of Biotechnology Sector

The biotechnology sector in China is rapidly evolving, presenting new opportunities for the laboratory chemicals market. As the country invests heavily in biotechnology research, the demand for specialized laboratory chemicals is expected to rise. In 2025, the biotechnology market is projected to reach approximately $80 billion, driving the need for chemicals used in genetic research, biopharmaceuticals, and diagnostics. This growth is likely to stimulate innovation within the laboratory chemicals market, as companies develop new products tailored to the specific needs of the biotechnology sector. The emergence of this sector is anticipated to create a dynamic environment for laboratory chemicals, fostering collaboration between chemical manufacturers and biotechnology firms.

Growth in Educational Institutions

The proliferation of educational institutions in China is contributing to the growth of the laboratory chemicals market. With an increasing number of universities and technical colleges focusing on science and technology, there is a heightened demand for laboratory chemicals to support educational programs. In 2025, it is projected that the number of higher education institutions will exceed 3,000, leading to a corresponding increase in laboratory facilities. This growth is likely to create a substantial market for laboratory chemicals, as educational institutions require a diverse range of chemicals for experiments and research projects. The laboratory chemicals market is expected to benefit from this trend, as educational institutions invest in modern laboratory equipment and supplies.

Expansion of Pharmaceutical Industry

The pharmaceutical industry in China is undergoing rapid growth, which is significantly impacting the laboratory chemicals market. With the increasing prevalence of chronic diseases and an aging population, the demand for pharmaceuticals is on the rise. In 2025, the pharmaceutical market is projected to reach approximately $150 billion, necessitating a corresponding increase in laboratory chemicals for drug development and testing. This expansion is likely to drive innovation in laboratory practices, as companies seek to enhance their product offerings. Consequently, the laboratory chemicals market is expected to benefit from this growth, as pharmaceutical companies require a wide range of chemicals for research, formulation, and quality control processes.

Government Regulations and Compliance

The laboratory chemicals market in China is influenced by stringent government regulations aimed at ensuring safety and environmental protection. Regulatory bodies are enforcing compliance standards that require laboratories to utilize high-quality chemicals that meet specific safety criteria. This regulatory landscape is likely to drive demand for laboratory chemicals that adhere to these standards, as non-compliance can result in significant penalties. In 2025, it is estimated that compliance-related expenditures in laboratories will account for around 10% of their operational budgets. As laboratories strive to meet these regulations, The laboratory chemicals market is expected to see increased demand for certified and compliant products, enhancing market growth.

Increasing Research and Development Activities

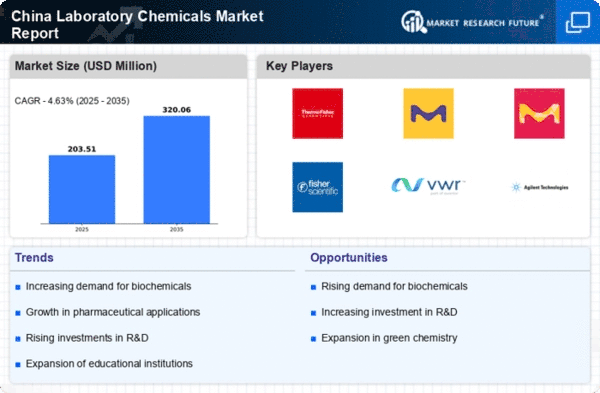

The laboratory chemicals market in China is experiencing a notable surge due to the increasing investment in research and development (R&D) activities across various sectors. The government has been actively promoting innovation, leading to a rise in the number of research institutions and laboratories. This trend is reflected in the allocation of approximately $50 billion towards R&D in 2025, which is expected to drive the demand for laboratory chemicals. As a result, the laboratory chemicals market is likely to expand, catering to the diverse needs of these research facilities. The growing emphasis on scientific research is anticipated to create a robust environment for the laboratory chemicals market, fostering advancements in various fields such as pharmaceuticals, biotechnology, and environmental science.