Rising Awareness of Home Infusion Benefits

There is a growing awareness among healthcare professionals and patients regarding the benefits of home infusion therapies. The home infusion-therapy-devices market is likely to gain traction as more stakeholders recognize the advantages of at-home treatment, such as reduced hospital stays and lower healthcare costs. Educational initiatives and outreach programs are being implemented to inform patients about the efficacy and safety of home infusion therapies. This increased awareness is expected to drive demand for home infusion devices, as patients seek to manage their conditions more effectively from home. As a result, the market is poised for growth, with an increasing number of patients opting for home-based infusion solutions.

Technological Innovations in Infusion Devices

The home infusion-therapy-devices market is being propelled by rapid technological innovations that enhance the functionality and usability of infusion devices. Recent advancements include the development of smart infusion pumps equipped with connectivity features that allow for remote monitoring and data sharing. These innovations not only improve patient safety but also facilitate better management of infusion therapies. In China, the infusion pump market is projected to reach $1.5 billion by 2026, indicating a robust growth trajectory. As healthcare providers increasingly adopt these advanced technologies, the home infusion-therapy-devices market is likely to expand, offering patients more effective and user-friendly treatment options.

Aging Population and Increased Healthcare Needs

China's demographic landscape is undergoing a significant transformation, with a rapidly aging population that is expected to reach 400 million by 2040. This demographic shift is likely to create a substantial increase in healthcare needs, particularly for chronic disease management. The home infusion-therapy-devices market stands to benefit from this trend, as older adults often require ongoing medical treatments that can be effectively managed at home. The demand for infusion therapies is anticipated to rise, as these devices provide a convenient and efficient means of delivering medications. Furthermore, the government is likely to support initiatives aimed at improving home healthcare services, which could further enhance the market's growth prospects.

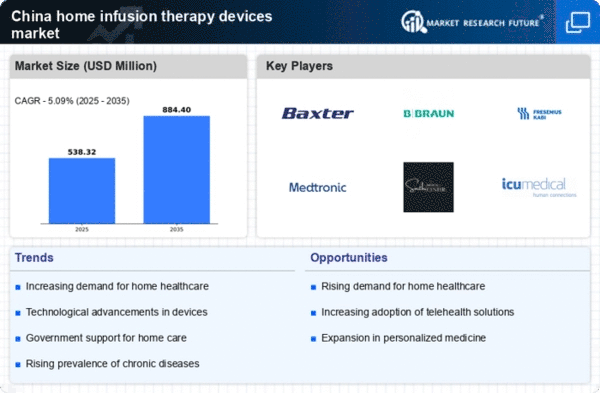

Increasing Demand for Home Healthcare Solutions

The home infusion-therapy-devices market is experiencing a notable surge in demand for home healthcare solutions in China. This trend is largely driven by the growing preference for at-home treatment options among patients, particularly those with chronic conditions. As healthcare costs continue to rise, patients are increasingly seeking alternatives that allow them to receive care in the comfort of their homes. According to recent data, the home healthcare market in China is projected to grow at a CAGR of approximately 15% over the next five years. This shift towards home-based care is likely to bolster the home infusion-therapy-devices market, as more patients require infusion therapies that can be administered outside of traditional clinical settings.

Government Initiatives to Promote Home Healthcare

The Chinese government is actively promoting home healthcare services as part of its broader healthcare reform agenda. This initiative aims to alleviate the burden on hospitals and improve access to care for patients, particularly in rural areas. The home infusion therapy devices market is likely to benefit from these government efforts, as policies are being developed to support the integration of home-based therapies into the healthcare system. Financial incentives and subsidies for home healthcare providers may further stimulate market growth. As the government continues to invest in healthcare infrastructure and services, the home infusion-therapy-devices market is expected to expand, providing patients with more options for receiving care at home.