Growing Health Consciousness

The increasing awareness of health and wellness among consumers in China appears to be a primary driver for the glycine supplement market. As individuals become more informed about the benefits of dietary supplements, the demand for glycine, known for its potential to enhance sleep quality and support muscle recovery, is likely to rise. Reports indicate that the health supplement sector in China is projected to grow at a CAGR of approximately 10% over the next five years. This trend suggests that consumers are actively seeking natural solutions to improve their overall well-being, thereby propelling the glycine supplement market forward.

Increased Focus on Mental Health

The growing emphasis on mental health and cognitive function in China is likely to impact the glycine supplement market positively. Glycine is believed to have calming effects and may aid in reducing anxiety and improving sleep quality. As mental health awareness rises, consumers are more inclined to explore supplements that support cognitive well-being. Recent surveys indicate that nearly 40% of Chinese consumers are actively seeking products that promote mental health. This shift in consumer priorities could lead to an increased demand for glycine supplements, positioning the industry for potential expansion.

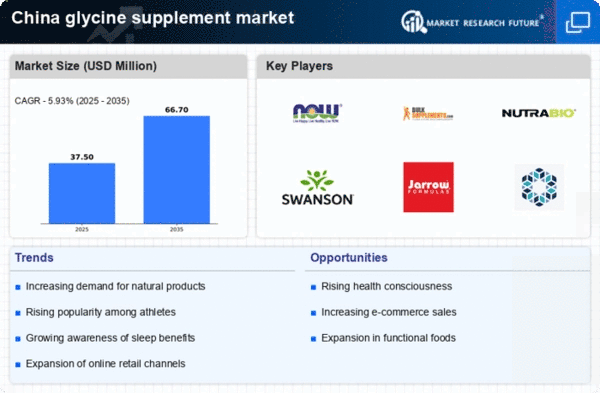

Expansion of E-commerce Platforms

The rapid growth of e-commerce in China significantly influences the glycine supplement market. With the increasing penetration of the internet and mobile devices, consumers are more inclined to purchase supplements online. E-commerce platforms provide a convenient avenue for consumers to access a variety of glycine products, often at competitive prices. Data indicates that online sales of health supplements in China accounted for over 30% of total sales in recent years. This shift towards online shopping is likely to enhance market accessibility and visibility for glycine supplements, fostering growth in the industry.

Rising Interest in Sports Nutrition

The burgeoning interest in sports and fitness among the Chinese population is likely to drive the glycine supplement market. As more individuals engage in physical activities, the demand for supplements that support muscle recovery and performance is increasing. Glycine, recognized for its role in protein synthesis and muscle repair, is becoming a favored choice among athletes and fitness enthusiasts. Market analysis suggests that the sports nutrition segment in China is expected to grow by approximately 15% annually, indicating a robust opportunity for glycine supplements to capture a share of this expanding market.

Influence of Traditional Chinese Medicine

The integration of glycine into the framework of Traditional Chinese Medicine (TCM) may serve as a catalyst for the glycine supplement market. TCM emphasizes the balance of bodily functions and the use of natural ingredients for health benefits. Glycine, with its potential to support liver health and improve sleep, aligns well with TCM principles. As consumers increasingly seek holistic approaches to health, the glycine supplement market could benefit from this cultural inclination towards natural remedies. This trend suggests a potential for growth as TCM continues to gain traction among health-conscious individuals.