Rising Geriatric Population

The increasing geriatric population in China is a pivotal driver for the endoprosthesis market. As the population ages, the prevalence of degenerative diseases and conditions requiring surgical interventions rises. It is estimated that by 2030, approximately 25% of China's population will be over 60 years old. This demographic shift necessitates advanced medical solutions, including endoprostheses, to enhance mobility and quality of life. The demand for joint replacements, particularly hip and knee prostheses, is expected to surge, contributing to market growth. Furthermore, the endoprosthesis market is likely to see innovations tailored to the needs of older patients, such as materials that reduce the risk of complications and improve longevity of implants.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure and funding for medical technologies are crucial for the endoprosthesis market. The Chinese government has been increasing its investment in healthcare, with a focus on enhancing surgical capabilities and access to advanced medical devices. In recent years, funding for orthopedic research and development has seen a notable rise, which is expected to continue. This support is likely to foster innovation within the endoprosthesis market, enabling manufacturers to develop more effective and affordable solutions. Additionally, public health campaigns promoting joint health and mobility may further stimulate demand for endoprosthetic devices.

Growing Incidence of Lifestyle Diseases

The rising incidence of lifestyle-related diseases in China is a significant driver for the endoprosthesis market. Conditions such as obesity, diabetes, and osteoarthritis are becoming increasingly prevalent, leading to a higher demand for surgical interventions. It is estimated that by 2025, the number of knee replacement surgeries in China could increase by over 30% due to these health issues. The endoprosthesis market is likely to respond by offering a wider range of products tailored to address these specific conditions, thereby expanding its market reach. This trend underscores the need for effective solutions to manage the consequences of lifestyle diseases.

Technological Innovations in Prosthetics

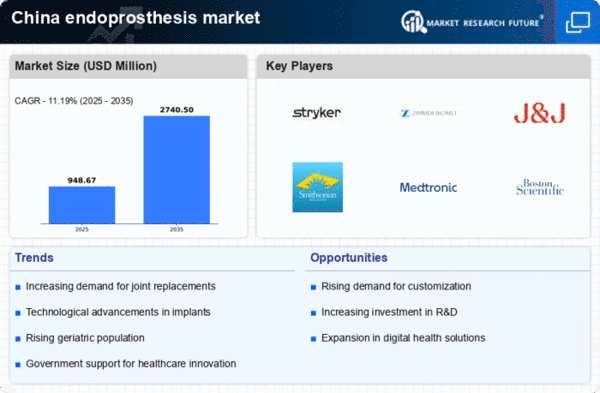

Technological advancements in prosthetic design and materials are significantly influencing the endoprosthesis market. Innovations such as 3D printing and biocompatible materials are enhancing the customization and effectiveness of prosthetic devices. In 2025, the market for advanced prosthetics in China is projected to reach approximately $1.5 billion, driven by these technological improvements. Enhanced imaging techniques and robotic-assisted surgeries are also streamlining procedures, leading to better patient outcomes. The endoprosthesis market is likely to benefit from these developments, as they not only improve the functionality of prosthetics but also reduce recovery times, making them more appealing to both patients and healthcare providers.

Increased Investment in Healthcare Infrastructure

The ongoing investment in healthcare infrastructure in China is a vital driver for the endoprosthesis market. As the government prioritizes healthcare improvements, hospitals and clinics are being equipped with advanced surgical technologies and facilities. This expansion is expected to enhance the capacity for orthopedic surgeries, including those involving endoprostheses. By 2025, it is projected that healthcare spending in China will exceed $1 trillion, with a significant portion allocated to orthopedic care. The endoprosthesis market stands to gain from this trend, as improved infrastructure facilitates better access to surgical procedures and enhances patient outcomes.