Focus on Energy Efficiency

Energy efficiency is emerging as a critical driver for the edge ai-software market in China. As organizations strive to reduce operational costs and minimize their carbon footprint, the demand for energy-efficient AI solutions is on the rise. Edge AI software can optimize energy consumption by processing data locally, which reduces the need for energy-intensive data transmission to cloud servers. This is particularly relevant in sectors such as manufacturing and logistics, where energy costs can significantly impact profitability. Recent studies suggest that implementing edge AI solutions can lead to energy savings of up to 30% in certain applications. Consequently, the edge ai-software market is likely to see increased investment as companies prioritize sustainability alongside technological advancement.

Integration with IoT Devices

The integration of edge ai-software with Internet of Things (IoT) devices is significantly influencing the market landscape in China. As IoT adoption accelerates, the need for intelligent edge computing solutions becomes increasingly apparent. Edge AI enables devices to process data locally, which is essential for applications requiring low latency and high reliability. For instance, smart cities and autonomous vehicles are leveraging edge AI to enhance their operational capabilities. The edge ai-software market is expected to benefit from this trend, with projections indicating that the number of connected IoT devices in China could reach over 1 billion by 2026. This proliferation of IoT devices necessitates robust edge AI solutions to manage and analyze the vast amounts of data generated, thereby driving market growth and innovation.

Advancements in AI Algorithms

The continuous advancements in AI algorithms are playing a pivotal role in shaping the edge ai-software market in China. Innovations in machine learning and deep learning techniques are enabling more sophisticated data analysis at the edge, allowing for improved accuracy and efficiency in various applications. These advancements are particularly beneficial in sectors such as healthcare, where real-time data analysis can lead to better patient outcomes. Furthermore, the edge ai-software market is witnessing a shift towards more adaptive and self-learning algorithms, which can enhance the performance of edge devices. As these technologies evolve, they are expected to drive further adoption of edge AI solutions across multiple industries, thereby fostering a competitive landscape that encourages ongoing research and development.

Rising Demand for Real-Time Data Processing

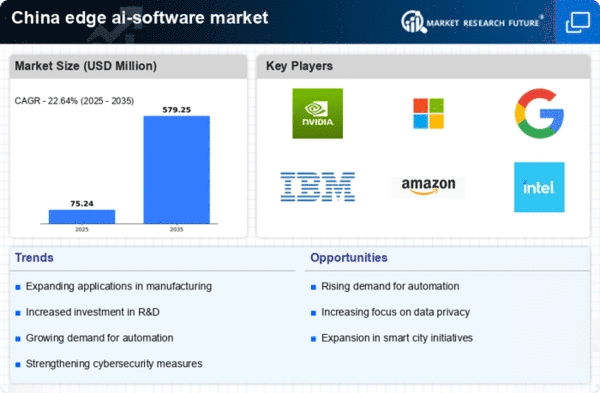

The edge ai-software market in China is experiencing a notable surge in demand for real-time data processing capabilities. Industries such as manufacturing, healthcare, and transportation are increasingly relying on edge AI solutions to analyze data at the source, thereby reducing latency and enhancing operational efficiency. This trend is driven by the need for immediate insights to support decision-making processes. According to recent estimates, the market for edge AI solutions in China is projected to grow at a CAGR of approximately 25% over the next five years. This growth is indicative of a broader shift towards decentralized computing, where data is processed closer to its origin, minimizing the need for extensive data transmission to centralized cloud servers. As a result, the edge ai-software market is poised to play a crucial role in the digital transformation of various sectors across the country.

Increased Investment in Smart Infrastructure

Investment in smart infrastructure is significantly impacting the edge ai-software market in China. The government and private sector are increasingly allocating resources towards developing smart cities, transportation systems, and energy grids that leverage edge AI technologies. This trend is driven by the need for enhanced efficiency, safety, and sustainability in urban environments. For instance, smart traffic management systems utilize edge AI to optimize traffic flow and reduce congestion. According to recent reports, investments in smart infrastructure are projected to exceed $500 billion by 2030 in China. This influx of capital is likely to accelerate the deployment of edge AI solutions, thereby expanding the market and creating new opportunities for innovation and collaboration.