Rising Demand for Cloud Solutions

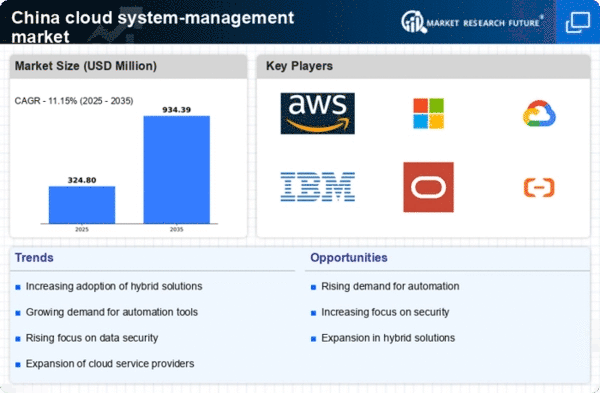

The cloud system-management market in China experiences a notable surge in demand as businesses increasingly adopt cloud solutions to enhance operational efficiency. This trend is driven by the need for scalable resources and cost-effective IT management. According to recent data, the market is projected to grow at a CAGR of approximately 25% over the next five years. Companies are recognizing the advantages of cloud-based systems, which offer flexibility and accessibility. As organizations transition from traditional IT infrastructures to cloud environments, the The cloud system-management market will expand significantly, catering to diverse sectors such as finance, healthcare, and manufacturing. This shift not only streamlines processes but also enables businesses to focus on core competencies, thereby fostering innovation and competitiveness in the market.

Government Initiatives and Support

The cloud system-management market in China benefits from robust government initiatives aimed at promoting digital transformation across various industries. The Chinese government has implemented policies that encourage the adoption of cloud technologies, providing financial incentives and support for businesses transitioning to cloud-based systems. This strategic focus on digital infrastructure is expected to bolster the market, with investments in cloud computing projected to reach $30 billion by 2026. Furthermore, the government's commitment to enhancing cybersecurity measures and data protection regulations creates a conducive environment for cloud service providers. As a result, the The cloud system-management market will witness accelerated growth, driven by both public and private sector collaborations.

Increased Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the cloud system-management market in China, as organizations seek to optimize their IT expenditures. By migrating to cloud-based solutions, companies can significantly reduce capital costs associated with hardware and maintenance. A recent analysis indicates that businesses can save up to 40% on IT costs by leveraging cloud services. This financial incentive is particularly appealing to small and medium-sized enterprises (SMEs) that may lack the resources for extensive IT infrastructure. As the demand for cost-effective solutions rises, the cloud system-management market is poised for growth, with providers offering tailored services that align with the budgetary constraints of various organizations.

Emergence of Hybrid Cloud Solutions

The cloud system-management market in China is witnessing a shift towards hybrid cloud solutions, which combine public and private cloud environments. This trend is driven by the need for flexibility and enhanced data control, allowing organizations to tailor their cloud strategies according to specific requirements. Hybrid cloud solutions enable businesses to maintain sensitive data on private clouds while utilizing public clouds for less critical operations. This approach not only optimizes resource allocation but also enhances security and compliance. As organizations increasingly adopt hybrid models, the cloud system-management market is likely to expand, with providers developing innovative solutions to meet the diverse needs of their clients.

Growing Importance of Data Analytics

Data analytics is becoming increasingly vital in the cloud system-management market in China, as organizations seek to leverage data for informed decision-making. The integration of advanced analytics tools within cloud platforms allows businesses to gain insights into operational performance and customer behavior. This trend is particularly relevant in sectors such as retail and finance, where data-driven strategies can lead to competitive advantages. The market for data analytics in cloud environments is expected to grow substantially, with estimates suggesting a potential increase of 30% by 2027. As companies prioritize data analytics capabilities, the cloud system-management market is likely to evolve, offering enhanced functionalities that cater to the analytical needs of various industries.